Read this article in 中文 Français Deutsch Italiano Português Español

Global construction equipment sales are still faltering. When will they recover?

20 October 2025

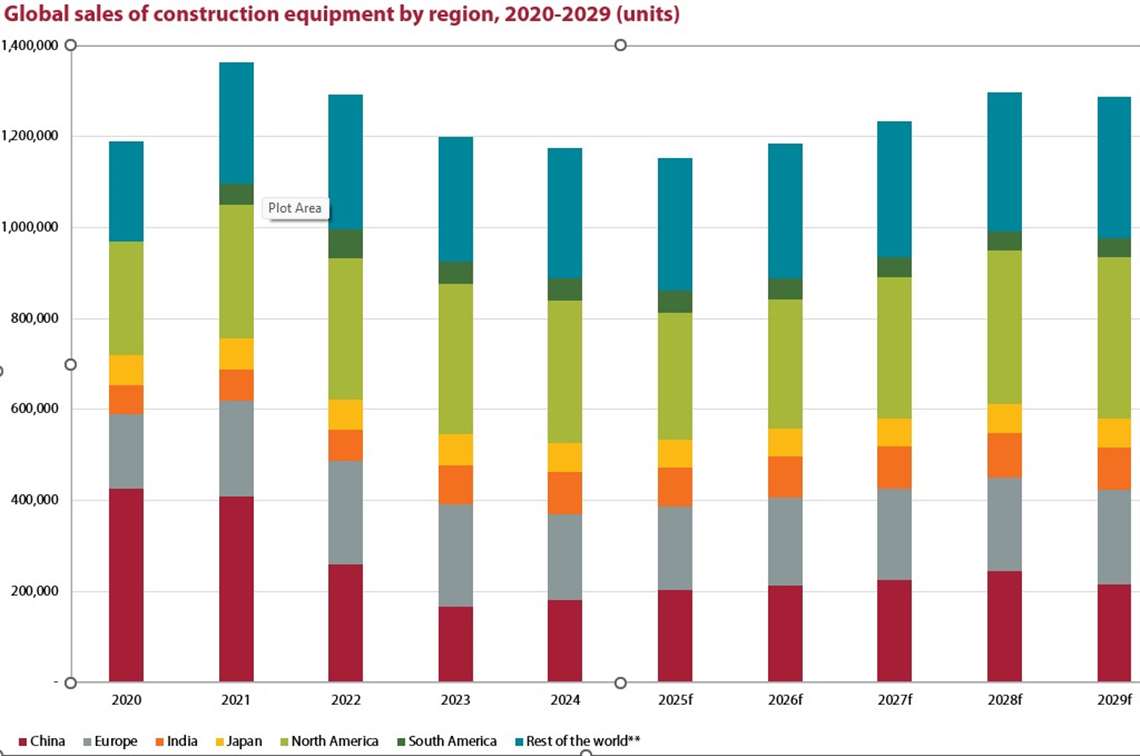

The most recent peak in global construction equipment sales was in 2021, when the market hit a record high of 1.36 million units sold, according to specialist market researcher and forecaster, Off-Highway Research. This was a result of low interest rates and government stimulus around the world in reaction to the Covid pandemic.

Construction sales are cyclical, with steady growth expected from 2026 until the early 2030s Image: Adobe Stock

Construction sales are cyclical, with steady growth expected from 2026 until the early 2030s Image: Adobe Stock

That growth continued unabated throughout 2022 in all major markets except China, where sales started to plummet due to the end of the stimulus spending programme and the emergence of enormous bad debts in the real estate market. Overall global construction equipment sales fell 5% in 2022, but the drop was entirely due to China. Global sales, excluding China, were up 7% in 2022.

More sustainable levels of construction equipment sales

Markets outside China started to cool in 2023, and ever since have been adjusting back down to more sustainable levels. The most specific brake has been rising interest rates around the world – a necessary tactic to curb runaway inflation – which has slowed down residential building. Despite that, inflation has had a direct impact on the market, with project costs rising while, at the same time, the cost of the equipment itself has also increased sharply.

After a steep global fall in 2023, last year saw the decline in global equipment sales decelerate, with only a 2% drop. In a reversal of the previous year, the developed markets of Europe, Japan and North America all fell (Europe landing particularly hard and painfully), while emerging equipment markets all generally improved.

Most markets will be flat to down this year, but the overall impact is forecast to only be a further 2% decline in global sales.

China to see (some) growth

The Chinese construction equipment market should continue to grow for the rest of the decade, but at a more moderate pace than has been the case in previous years Image: Adobe Stock

The Chinese construction equipment market should continue to grow for the rest of the decade, but at a more moderate pace than has been the case in previous years Image: Adobe Stock

On the positive side, China will see growth in 2025 – but that is not to say the market is healthy. Far from it. The real estate segment is still very distressed and local governments are deep in debt. There is no obvious way for the Provinces to repair their finances and start funding projects again, because the previous strategy was always to sell land to real estate developers.

The 12% sales growth expected in China this year will come mostly from sales of electric equipment, as did the majority of the growth last year.

China is the only market in the world where electric construction equipment has genuinely taken hold, particularly in wheeled loaders, where sales of electric machines are poised to overtake diesels in the next year or two. Scrappage schemes to take older and more polluting diesel machines out of the active fleet and subsidies around electrification have been helpful, as has the ferocious competition between China’s leading OEMs, which has driven down prices.

The Chinese market should continue to grow for the rest of the decade. However, without a major change in the factors which drive the market, it will be a long road back to a truly healthy market. At the moment, back to ‘normal’ looks at least five years away.

Construction in Europe suffering from instability

High interest rates and high construction costs have depressed house building across the region for the last two to three years, and the relative buoyancy in the infrastructure segment has not been enough to offset the sharp correction this caused in the construction equipment market in 2024.

The situation in Europe was made worse toward the end of the year by unprecedented political instability in the region, with the collapse of governments in Austria, France and Germany in the space of three months.

Unsurprisingly, the uncertainty these events caused led to these three countries seeing the steepest percentage declines in the region for their construction equipment markets. The continuing political turmoil in France means it will be the worst performing market in Europe this year too.

‘Less worse’ last year were markets in Southern and Eastern Europe, which suffered more limited declines. However, the downturn was widespread, with only Ireland seeing an increase in equipment sales last year.

Despite improvements in a number of key countries this year, including Germany and the UK, equipment sales in Europe are expected to slide a further 2% in 2025. France will be the biggest negative factor, but demand in Benelux and the Nordic regions is also weak. The recent collapse of the Dutch government may worsen that outlook.

On the positive side, Southern Europe remains generally strong and on a growth trajectory.

North America tariff uncertainty impacts construction

Global sales of construction equipment by region, 2020-2029 (Units)

Global sales of construction equipment by region, 2020-2029 (Units)

The 5% decline in North American equipment sales last year was more limited than it might have been. Housebuilding remained strong, and even rose slightly, despite high interest rates, and was particularly helpful in sustaining compact equipment sales. Meanwhile, the infrastructure segment remained strong, and the non-residential building segment has been helped by several large micro chip factory and data centre projects.

The cyclical decline is expected to continue this year and is likely to be made much worse by the Trump Administration’s inflationary and anti-trade tariffs policy including, August’s Section 232 tariffs on steel-derived products.

The high steel content of construction equipment means that imported machines (about 20% of the market) will be almost 50% more expensive. Meanwhile, machines from US-based manufacturers largely using components sourced in the US could see cost increases of about 20% due to the components they import from abroad and the foreign content in the parts they source within their borders.

The lack of clarity on tariffs and the ongoing shifts in policy breeds uncertainty in the market and an erosion of confidence. This will lead to investments being delayed and Off-Highway Research believes the North American market will fall 11% this year as a result. This would be the biggest decline for any major market in 2025.

Next year could be better – the fundamental drivers, such as the need for housing and the data centre boom (accompanied by enormous power requirements) should all be good for the industry. But continued inflation from tariffs (which might force interest rate increases), a presence in the region of a large fleet of young machines from the boom of the early 2020s, ongoing uncertainty and chaotic policy-making could derail this.

India is a growing construction market

With demands for housing and infrastructure rising every year there will always be a demand for construction equipment Image: Adobe Stock

With demands for housing and infrastructure rising every year there will always be a demand for construction equipment Image: Adobe Stock

Construction equipment sales in India grew 10% to a new record high last year. The general election did not prove as disruptive to the industry as it usually is and new emissions regulations for road-mobile construction equipment – which came into force at the start of 2025 – meant there was a significant sales surge in the final months of the year. This so called ‘pre buying’ is common when legislative changes will add to the cost of equipment.

That seems to have effectively moved sales from 2025 into 2024, and a 9% decline is expected this year as a result. In addition, there are concerns that the pace of roadbuilding activity could slow due to a reduction in the number of tenders being put out by the government.

However, these are small disruptions in the bigger picture of the Indian equipment market, which continues to exhibit strong long-term growth, and which is now comfortably the third largest territory in the world in volume terms after the US and China.

Japan market fluctuations

After an unusually sharp increase (for Japan) of 7% in 2023, the market suffered an equally steep fall in 2024, with a decline in sales of 9%. At just under 63,000 units last year, the market is a little below what would be considered its natural level of around 65,000 machines per year.

Although volumes were low in 2024, the expectation is that the market will remain at this somewhat depressed level for the next one to three years. This is partly because the high sales volumes of the pandemic years mean there is a relatively large fleet of young machines available in the Japanese fleet, and partly because there is a sense of uncertainty due to the unpredictable policymaking of President Trump and what this might mean for the global economy.

South American inflation hurts equipment sales

The inflationary environment of 2023 saw the South American construction equipment market turn down steeply after the unprecedented peak of 2022. There was a modest 1% rebound in volume terms last year, which was driven by mining, oil and gas.

The market is expected to now enter a shallow cyclical decline for most of the rest of the decade, with fleets having been refreshed by the sharp spike in sales in the early 2020s.

However, equipment associated with mining should still perform well thanks to a reasonably buoyant outlook for various commodities. Ther nature of mining is that it tends to focus on lower volume/higher cost types of equipment, so while the forecast is for a decline in volume terms, the overall value and general health of the South American equipment segment should remain reasonable.

Rest of the world

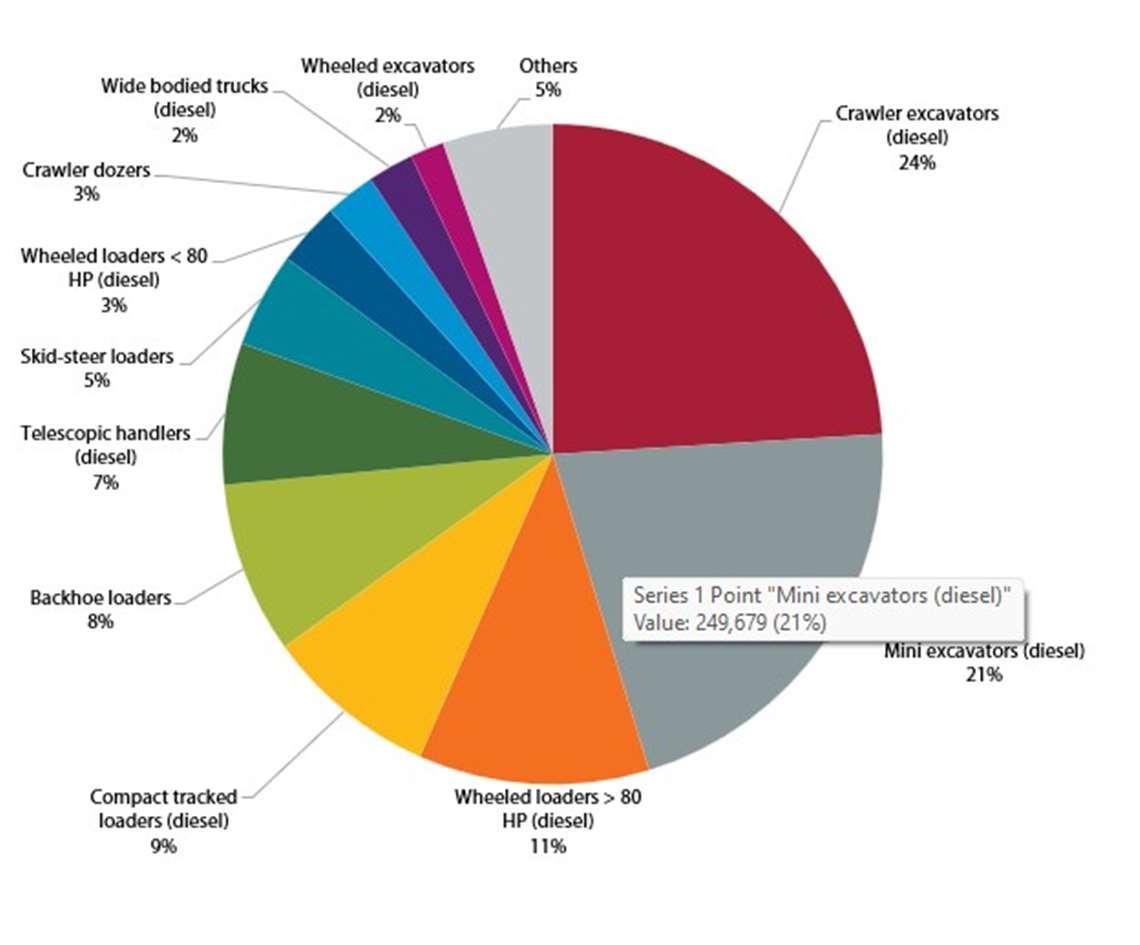

Global sales construction equipment by type, 2024, units

Global sales construction equipment by type, 2024, units

Like South America, the other equipment markets around the world are predominantly emerging economies with some sort of extraction industry at the heart of their wealth creation. High commodity prices meant this disparate group of countries achieved a 5% increase in sales last year. This followed on from the dip that was seen in 2023 when high interest rates and high inflation derailed growth.

The global outlook for commodity prices for the next few years is that they will remain at reasonably high levels, and Off-Highway Research believes these will be strong enough to drive modest growth in equipment sales.

Looking to the future of construction equipment sales

Off-Highway Research’s forecast is for steady growth in construction equipment sales both globally and in the individual regions from 2026 onwards. This should lead the markets to a cyclical peak in the early 2030s which, in volume terms, should eclipse the stimulus-driven high of 2021.

This is a point worth remembering at times like these. Construction equipment sales always grow over time. The world’s population is growing, which demands infrastructure and housing, and the construction industry that has to deliver this is becoming increasingly mechanised. Evening out the ups and downs of the cycle, this equates to a compound annual growth rate (CAGR) of around 2%.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM