Read this article in 中文 Français Deutsch Italiano Português Español

Growth stalls for European contractors in 2025

26 August 2025

There is likely to be no growth in the European construction sector this year, according to a market report by global bank ING.

Construction growth in Europe in 2025 is expected to be limited. Image: Adobe Stock

Construction growth in Europe in 2025 is expected to be limited. Image: Adobe Stock

The report states that, despite significant housing shortages, residential construction is unlikely to rise this year.

The issuance of building permits for new houses in the EU has reached its lowest point and is displaying slight improvement. Yet, the granting of permits is still very low compared to 2021, especially in Germany and Austria. In these countries, issuance has fallen by more than 40%.

A positive outlier is Spain. The housing market in Spain is heating up and house prices are surging. This has created a strong business case for new developments, resulting in a sharp rise in building permits in recent years.

In the Netherlands, there was an upswing in issued permits in 2024, yet during the first half of 2025 it looks like this increase has ended. Like other European countries, there are several bottlenecks: a shortage of (affordable) building land, complex project development, and legal delays.

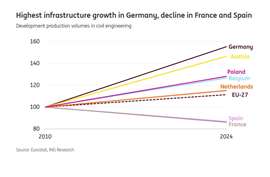

European infrastructure investment

While the infrastructure sector continues to grow it will do so modestly. EU infrastructure investments grew in 2023 (4.7%) and 2024 (0.6%), supporting total construction production volumes. The subsector benefits from much-needed investment in the energy transition, especially for new power grids and digital infrastructure.

Infrastructure is the best performing sub sector in European construction. Image: ING

Infrastructure is the best performing sub sector in European construction. Image: ING

In Germany, investments increased by more than 55% between 2010-24. That is needed because German infrastructure is in a patchy state, and investments in roads and digital infrastructure are driving some growth in this subsector. Germany launched a €500 billion (US$580 billion) infrastructure and climate investment plan last year, which will result in further growth in the coming years.

In France, the majority of building firms are planning to decrease sales prices, due to sluggish demand. By comparison, high price increases are expected in the Netherlands, Poland and Turkey. In Turkey, inflation is still high, resulting in steeper construction prices. In the Netherlands, demand is improving, allowing builders to increase prices.

In its report ING says that, “While some modestly positive signals are beginning to surface, they are nothing to write home about. Contractors remain pessimistic, though the situation appears to have bottomed out.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM