Why European construction could be set for a downturn in 2024

05 September 2023

Image: marcinjozwiak via AdobeStock - stock.adobe.com

Image: marcinjozwiak via AdobeStock - stock.adobe.com

The construction industry in Europe could start to shrink in 2024, according to the latest forecast from economists at Dutch bank ING.

ING warned that high interest rates and soaring building costs have “drastically reduced” demand for new buildings in Europe.

It said that ongoing projects and a heightened focus on sustainability have so far prevented construction volumes from shrinking but it predicted a decline would start to emerge next year (2024).

Nonetheless, ING upgraded its previous forecast for European Union (EU) construction volumes in 2023 to zero growth.

That was mainly down to a better-than-expected first half of the year, while construction volumes have stayed high.

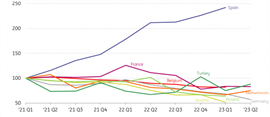

Justifying its upgraded forecast, ING pointed to construction production being at the same level in June 2023 as in the same period a year before, and a healthy backlog of work, with 8.9 months of guaranteed projects at the beginning of the third quarter of this year.

But ING warned that there were “clear signs” of volumes starting to shrink, with home buyers and companies reluctant to invest in new buildings amid a weaker economy, high interest rates and increasing building costs.

It said that long lead times meant that this declining demand would take time to be reflected in construction output volumes.

Manufacturers of cement, bricks and concrete are already starting to see sharp declines in production, falling by an average of 13% across the EU in June compared to the same period last year.

As a result, it has forecast a “modest” decline of 1% in 2024 for EU construction volumes.

Image: European Commission, ING Research

Image: European Commission, ING Research

Renovation to counterbalance new building

On a more positive note, ING said it expected the renovation market to counterbalance a decline in the new building sector.

The demand for renovation and maintenance, which accounts for more than 50% of total construction production, is less affected by economic cycles.

ING also suggested that sustainability and energy-related factors meant that the R&M market would show further growth.

Government support for sustainability measures and high energy prices are likely to provide an extra trigger, it argued.

Declining confidence

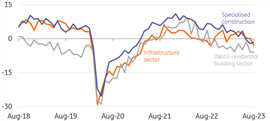

However, confidence among some construction companies is showing signs of starting to decline, ING said.

Indicators among specialist construction companies were marginally negative for the first time in more than two years in June.

That subsector contains construction businesses that are active in repair and maintenance such as installation, plasterers, carpenters, painters and glaziers.

Meanwhile, confidence in infrastructure went into negative territory in August, despite the need for infrastructure upgrades and investment in energy infrastructure.

Image: European Commission, ING Research

Image: European Commission, ING Research

Construction companies no longer increasing prices

ING found that the number of contractors increasing their prices is falling, thanks to the lower cost of some building materials and increasing competition from rivals amid weakening demand.

In August 2022, around 65% of companies in Austria and the Netherlands responded to surveys saying that they were scheduling sales price increases.

In August this year, that fell to just 8% in Austria and 20% in the Netherlands. In Germany, the majority of building companies now plan on decreasing prices.

Click here to read ING’s full article, including forecasts for individual European markets.

Image: European Commission, ING Research

Image: European Commission, ING Research

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM