Read this article in French German Italian Portuguese Spanish

What machine sales tell us about the state of European construction

12 September 2025

Image: Leonid Andronov via AdobeStock - stock.adobe.com

Image: Leonid Andronov via AdobeStock - stock.adobe.com

There are signs of a recovery – albeit a fragile one – in the European construction market, according to new analysis tracking the sale of construction machinery in the region.

In its most recent market update, the Committee for European Construction Equipment (CECE), which represents European Construction Equipment manufacturers, said it expected Europe’s construction machinery market to bottom out this year.

Sebastian Popp, economic affairs manager at CECE said that although sales of equipment were down 1.1% in the first half of 2025, the stage is set for a modest rebound in the second half of the year.

“We are seeing this long-anticipated market recovery, but at the same time, it is certainly a very fragile one”, said Popp, “We have had the special situation in the second quarter of Bauma, our leading trade show. That always gives a temporary boost to sales…And at the same time, we do have uncertainties that we are facing, uncertainties that are only getting bigger.”

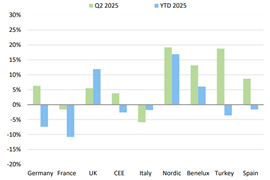

Construction equipment sales on the European market Jan-June 2025 compared to previous year in % (Source: CECE)

Construction equipment sales on the European market Jan-June 2025 compared to previous year in % (Source: CECE)

If the signs of a nascent recovery in Europe are positive, it is still important to remember that growth comes against a backdrop of persistent declines in sales since 2022. In 2023, the European market fell by 10% and in 2024 it dropped by another 19%.

And Popp noted that the early signs of a rebound are patchy. Sales in southern European nations have remained solid, while there are “signs of light” in the Nordics and Benelux countries. Germany, France and the UK, however, while still the top three markets, have fallen from a 55% share of European sales to 46%.

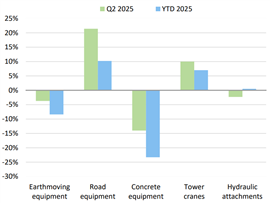

When it comes to machine categories, some are faring better than others: According to Popp, road machinery is seeing year-to-date growth of 10%, buoyed by investment in civil engineering and road infrastructure across Europe. Sales of light construction equipment like small compaction machines and concreting tools also appear relatively healthy, which Popp suggested is because they are less susceptible to the general economic climate.

Tower cranes too have grown by 7% in the first half of 2025 but that is against a “disastrous” 2024 where sales fell by 46%, reflecting the ongoing contraction of the residential construction market and some areas of the commercial sector. Popp pointed out that tower crane sales may have returned to growth, but that does not mean a return to normality.

Construction equipment sales on the European market Jan-June 2025 compared to previous year in % (Source: CECE)

Construction equipment sales on the European market Jan-June 2025 compared to previous year in % (Source: CECE)

Meanwhile, he noted that sales of earthmoving machinery appear to be bottoming out and could see a small increase in Q3 and Q4 of 2025. The year is likely to end with sales on the same level as 2024.

But there are no indications of a recovery in concrete machinery, which has suffered a 23% year-to-date decline in sales, again reflecting the ongoing weakness in the residential and commercial segments of the European construction market.

Business sentiment among European manufacturers is slowly improving and has returned to positive territory but may have been skewed by Bauma in April and isn’t moving particularly quickly.

That could help to explain why there was a slightly positive development of rental business during the first half of 2025, as construction companies opt to rent rather than buy machinery amid economic uncertainty and a weak investment climate.

A changing landscape

Also speaking at the CECE online event, Dr Nicholas Fearnley, head of global construction at Oxford Economics, said the wider European economy would see growth driven by consumers rather than government spending.

“What’s actually happening over the next few years is it’s going to be consumers driving economic growth. This makes sense because inflation’s fallen back a bit, real wages are going up, so consumers are going to be increasing their spending,” he said.

But he added,“The investment component, however, is quite low. Construction and investment is not going to be driving the same level of economic growth as perhaps we’ve got used to in previous years.”

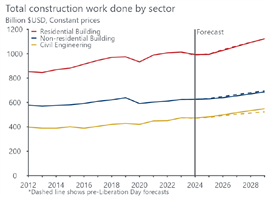

He said he expected Spain, Hungary, and Ukraine to be the main drivers of construction growth over the next few years. In Germany, a €500 billion infrastructure stimulus package is expected to support the construction industry. But the picture in France is less certain and Italy, which has seen several years of strong growth driven by infrastructure projects, is expected to go into reverse.

Source: Oxford Economics

Source: Oxford Economics

Across Europe in general, Dr. Fearnley said that growth this year is muted. Whereas residential building has been flat, commercial construction and civil engineering have seen growth. That growth will continue into 2026 and he said he expected residential building to pick up, with more interest rate cuts from the European Central Bank expected, possibly in December this year.

Meanwhile, he forecast that government spending would start to come under pressure throughout the region; “Obviously a lot of the civil engineering work is publicly funded. This is proving to be a challenge in Europe as you’re very much aware. We are seeing governments becoming more aware of budget deficits, trying to repair budgets, keep debt under control and reduce deficit spending,” he said.

One consequence of this could be in an increase in public-private investment partnerships, as is happening in Japan.

“So, there is scope to still build a lot, deliver transportation and utility infrastructure, but working with the private sector to be able to deliver this, and this is something that Europe could certainly continue to pursue as well,” he added.

A challenging environment for machinery exports

Last week, CECE warned that expanded US tariffs are expected to impact €2.8 billion of annual EU construction equipment exports to the United States.

That was after the Trump administration extended existing tariffs on aluminium and steel to 400 additional customs codes, bringing construction and mining machinery into scope.

Under the new regime, 50% tariffs apply to the value of a machine’s steel content, alongside a 15% baseline tariff on the rest of the unit. This means the effective rate will vary between 15% and close to 50%, depending on the composition.

Construction equipment exports in EUR million, *=Jan-May 2025 data and projection, source: national statistics bureaus (Source: CECE)

Construction equipment exports in EUR million, *=Jan-May 2025 data and projection, source: national statistics bureaus (Source: CECE)

Expanding on the situation, Popp said, “Some of our members are already saying that they see their entire US business threatened by these new and recent tariffs escalation.”

It is particularly bad news for European firms because they saw a huge boost to sales in North America in 2023 and 2024, driven by the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act. It made the US by far the most important non-European export market for European manufacturers (more than a quarter of EU exports go to North America).

The first half of the year has seen a 34% decline in sales to North America, even before the full effect of tariffs has been felt. Popp said that a one-third decline in exports to the US across the full year may prove to be an optimistic scenario and even then, that would see exports fall to 2021 levels.

“So it’s certainly very difficult times that we currently, frankly speaking, don’t have an answer to,” Popp said.

While signs of a recovery in Europe itself are likely to be welcomed by EU manufacturers, growth in their home region is unlikely to compensate for the expected reduction in exports.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM