Read this article in 中文 Français Deutsch Italiano Português Español

Eurozone construction activity decline accelerates but buyers turn optimistic

05 June 2025

A construction site in Ulm, Germany (Image: PRILL Mediendesign via AdobeStock - stock.adobe.com)

A construction site in Ulm, Germany (Image: PRILL Mediendesign via AdobeStock - stock.adobe.com)

Yet another reported decline from buyers in construction activity in the Eurozone is undoubtedly not good news, but it obscures a more positive message: confidence in some major markets is finally returning.

Construction buyers in the Eurozone reported an accelerated decline in construction activity in May, according to the latest Hamburg Commercial Bank (HCOB) Purchasing Managers’ Index (PMI).

The index scored 45.6 in May, down from 46.0 in April (any figure less than 50.0 represents a decline).

That indicated a sharp and stronger contraction in activity across the Euro area construction sector. It also marks the latest in a long line of negative results in the survey, which hasn’t seen a score above 50.0 since 2022.

There were steeper reductions in both Germany and France, with France seeing the quickest fall in three months.

By contrast, Italian companies reported an increase in activity for the third consecutive month, although the rate of growth was only marginal.

Housing was once again the worst-performing segment in the Eurozone as a whole, although there were also relatively sharp declines in commercial and civil engineering activity.

There was also a sharp drop in new orders, with French companies seeing the steepest decline, although the decline in new orders also worsened in Germany. But Italian companies recorded stronger growth in new orders.

Nonetheless, construction companies reported having an optimistic outlook for business activity over the coming year.

The future activity index for Germany reached a 40-month high, while in Italy it was at a 12-month high.

The picture is, admittedly, less positive in France, where buyers were at their most downbeat when it came to future activity in three months.

Norman Liebke, economist at Hamburg Commercial Bank, said that France and Germany were the main drags on activity, despite Italy standing out as a lone bright spot. He also acknowledged that demand conditions across the bloc remain weak, with companies continuing to cut back on employment and purchasing.

Nonetheless, he added, “Despite the bleak picture, a surprising shift occurred in business sentiment. For the first time in over three years, Eurozone construction firms turned optimistic about the year-ahead and approached its historical average. Confidence rebounded in Germany and Italy, with future activity indices hitting multi-month highs. France, however, remained the outlier, with sentiment dipping to its most pessimistic level in three months.

“Still, with activity and demand both falling sharply, the sector’s newfound optimism will need to be backed by tangible recovery signals to avoid becoming just another false dawn.”

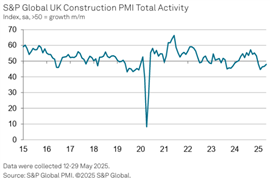

Signs that UK’s downturn is easing

There were also signs that a downturn in the UK is starting to ease, with buyers reporting a decline in activity and new orders dropping to their slowest pace since January.

The S&P Global UK Construction PMI registered a score of 47.9 in May, up from 46.6 in April.

House building was the weakest-performing segment in May (45.1). Civil engineering also declined (45.9), extending the period of contraction it has experienced to five consecutive months. But commercial work (49.5) fell only marginally and the rate of decline was the slowest since the downturn began in January.

Meanwhile, UK construction companies reported the least-marked decline in new orders for four months in May. Survey respondents attributed reduced order intakes to delayed decision-making among clients and cutbacks to capital spending budgets.

The picture also looked more positive when it came to business activity expectations. They rose to the highest since December 2024, with 39% of the survey panel forecasting a rise in output levels, while 16% predicted a decline.

Tim Moore, economics director at S&P Global Market Intelligence, said, “The construction sector continued to adjust to weaker order books in May, which led to sustained reductions in output, staff hiring and purchasing. However, the worst phase of spending cutbacks may have passed as total new work fell at a much slower pace than the near five-year record in February.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM