Read this article in Français Deutsch Italiano Português Español

Eurozone construction downturn deepens as order books shrink

12 August 2025

Construction buyers have reported another decline in construction activity in the Eurozone, with the pace accelerating in July.

The latest HCOB Eurozone Construction Purchasing Managers’ Index (PMI) showed the steepest decline in new orders since February.

The seasonally adjusted Total Activity Index dropped to 44.7, from 45.2 in June, marking the 39th consecutive month below the 50.0 threshold separating growth from contraction. Housing remained the worst-performing segment, although its rate of decline eased slightly, while civil engineering and commercial work also contracted.

France recorded the sharpest fall in output among the bloc’s three largest economies. By contrast, German construction companies reported a rate of decline that, while still sharp, was the weakest for two and a half years and suggested signs of a recovery.

Image: HCOB/S&P Global

Image: HCOB/S&P Global

Meanwhile, Italy posted its first decline in five months. Weak demand led to the fastest reduction in purchasing activity since December 2024, alongside continued job losses across most markets.

Sentiment remained negative, with only Italian firms forecasting growth. “The outlook for European construction companies remains weak,” said HCOB economist Norman Liebke.

He added, “Even though residential and commercial construction are no longer shrinking as sharply as they did in June, the recession is clearly visible. Civil engineering is not trending any better.

“The outlook for European construction companies remains weak. New orders continue to decline and fell by nearly four index points in July, and the employment situation remains tense. The construction companies themselves expect weak activity over the coming twelve months, with only the Italian companies remaining optimistic.”

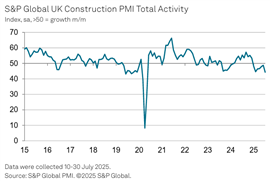

UK construction activity falls at fastest rate since May 2020

Construction buyers in the UK recorded the steepest fall in activity in more than five years in July, with the latest S&P Global UK Construction Purchasing Managers’ Index (PMI) showing sharp declines across all main sectors.

The headline PMI dropped to 44.3, from 48.8 in June, signalling a marked downturn driven by a fresh contraction in residential building and the steepest fall in civil engineering activity among the three monitored categories. Commercial construction also fell, albeit at a softer rate.

New orders declined for a seventh consecutive month, with firms citing fewer tender opportunities, site delays and weaker customer confidence. Employment levels continued to fall, while subcontractor usage was cut back even as their rates rose sharply.

Expectations for the year ahead remained subdued despite a slight improvement in business confidence from June’s recent low. Inflationary pressures eased, with input cost rises at their weakest since January.

Image: S&P Global

Image: S&P Global

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM