Read this article in Français Deutsch Italiano Português Español

Does disruption in the Red Sea mean more pain for construction supply chains?

18 January 2024

Container ships on the Suez Canal, Egypt (Image: Hladchenko Viktor via AdobeStock - stock.adobe.com)

Container ships on the Suez Canal, Egypt (Image: Hladchenko Viktor via AdobeStock - stock.adobe.com)

Just when it seemed that the world might be returning to business as usual, following a series of turbulent global events, the prospect of more supply chain disruption has reared its head again.

It’s not that long ago since the delays to deliveries of certain goods and materials that drove sharp price inflation started to stabilise, following the Covid-19 pandemic and the onset of the Ukraine war. Prices, while still at a far higher level than before the pandemic, have also started to fall.

But now there are concerns that attacks on shipping in the Gulf of Aden in the Red Sea by Houthi rebels in Yemen could once again disrupt supply chains and bring with it another spike in prices.

That’s because shipping companies have started taking the long way round, shunning the quicker Suez Canal route and sending vessels around the Cape of Good Hope instead – a voyage that takes a week to two weeks longer.

The problem is potentially significant because the Suez Canal ordinarily handles 30% of all global container traffic and goods worth over USD$1 trillion annually (equivalent to around 12% of global trade).

Global freight rates nearly doubled in the first two weeks of 2024, according to the Freightos Baltic Index and there are fears that could push prices in an upward direction once more. It’s worth noting though, that they are still well below their 2022 peak.

So what does it mean for the global construction industry?

At the moment, it may still be too early to tell.

“Since this started about four to six weeks ago, with ships starting to systematically route around Africa, we are still in the middle of the first cycle of ships arriving late to Europe and the US East Coast,” supply chain expert Mirko Woitzik, director, Intelligence Solutions, at Everstream Analytics, told Construction Briefing.

“It’s likely that the container lines will include the longer transit times in upcoming vessel schedules, so the expected time of arrival (ETA) certainty will only increase in the coming weeks. That will improve planning and reduce the risk of delays and stockouts.”

But in the intervening time, Woitzik expects that bulky equipment that can’t easily be moved any other way, could be affected.

“We assume that especially bulky and heavy equipment (including machine and engine parts but also a lot of other low-value construction goods) will have to continue to sail on container ships and be most affected by the current longer transit times,” Woitzik said.

“Other parts could be moved via air cargo if absolutely necessary (or companies simply have more inventory of critical parts). We see these decisions being made on a daily basis now with our customers, probably until the schedules become more certain after the Chinese New Year. Hence you see some companies like Ikea and Tesla announcing delays, while others with a more robust risk management approach are not being affected currently,” he added.

Andrea S. Patrucco, assistant professor of supply chain management, Department of Marketing and Logistics, Florida International University, takes a similar view, “While it’s still early to predict the full impact of these events, the situation does have the potential to cause disruptions in construction supply chains in the medium term, primarily through delayed shipments and increased transportation costs,” he told Construction Briefing.

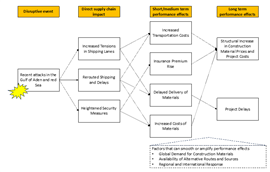

He has set out some of the areas that could potentially be affected in a conceptual map, reproduced below:

A conceptual map of supply chain risks following the Red Sea attacks (Image courtesy of Andrea S. Patrucco, assistant professor of supply chain management, Florida International University)

A conceptual map of supply chain risks following the Red Sea attacks (Image courtesy of Andrea S. Patrucco, assistant professor of supply chain management, Florida International University)

He added, “These waterways are crucial for global trade, especially for the transportation of energy and cargo shipments between Asia, the Middle East, and Europe. Any disruption in these regions can have a ripple effect on global shipping and logistics.

“The region is a key route for materials like steel and other construction commodities. The attacked ship was reportedly carrying steel products, highlighting the direct impact on construction supply chains.

“The availability of alternative sources and transportation routes for construction materials also plays a role. If suppliers can reroute or use different sources without substantial cost increases, the impact might be less severe. The impact on supply chains also depends on the current global demand for construction materials. A subdued demand, as compared to the higher demand in 2022, might mean that the industry is better positioned to absorb some of the disruptions.”

A persistent or short-lived problem?

Meanwhile Noble Francis, economics director at the Construction Products Association (CPA) in the UK, contended that there is a risk construction prices could rise if the situation drags on.

“Clearly, if disruptions persist, it will significantly affect some imported products through the delayed supply and rises in freight prices,” he said in a post on Linkedin.

In the UK, construction product prices were 2.3% lower in November 2023 than the year before, so the situation is different to when a massive container ship, the Evergiven, blocked the Suez Canal at a time when there were already supply issues, he argued.

Map of the Red Sea region (Image: Peter Hermes Furian via AdobeStock - stock.adobe.com)

Map of the Red Sea region (Image: Peter Hermes Furian via AdobeStock - stock.adobe.com)

Currently, there aren’t the same level of supply problems. But he warned, “Construction product prices are still 38.5% higher than in January 2020, pre-pandemic. Many small housebuilders and contractors are also suffering from the falls in private housing and repair and maintenance demand, while UK contractor insolvencies are already at their highest level since the financial crisis.

“So if disruptions persist in the Red Sea, this could lead to supply issues for some products and construction product price rises again.”

But Rico Luman, a senior economist at Dutch bank ING, forecast that the upward pressure on prices caused by attacks on ships in the Red Sea and Gulf of Aden should hopefully be short-lived.

“The current market balance of supply and demand is less strained than when Evergiven blocked the Suez Canal in 2021, which should limit the upside for container rates,” he said.

“Having said that, the impact ultimately depends on how long it takes to resume shipments. Rebalancing takes time as we have seen before. If extreme weather events add to the disarray, elevated freight rates could easily be around for longer.

“But the current disruption also masks underlying overcapacity following a massive inflow of vessel capacity. When the most pressing Red Sea disruption is resolved we can gradually expect renewed downward pressure.”

Whether the disruption can be resolved and how long it takes remains to be seen.

Following joint US-UK airstrikes on Houthi military facilities earlier this week, US intelligence was reported to have destroyed around a quarter of the rebels’ arsenal.

Nonetheless, attacks have continued, most recently on a US-owned vessel in the Gulf of Aden, reported to be carrying steel products. The ship reportedly suffered limited damage and headed out of the area.

Patrucco concluded, “The extent of this impact will depend on the duration of the disruption, the effectiveness of the international response, and the current global demand for construction materials. Particularly, the extent to which regional and international powers will intervene to secure these shipping lanes will be crucial. A strong and effective response could minimize disruptions, while a lack of coordinated action might exacerbate them.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM