Read this article in Français Deutsch Italiano Português Español

European contractors remain pessimistic, as UK falters

04 September 2025

Photo: Marr Contracting/John Zammit, courtesy of HS2

Photo: Marr Contracting/John Zammit, courtesy of HS2

Contractors in Europe’s two largest economies – Germany and France – remain pessimistic but their Italian counterparts have a sunnier outlook, according to the latest survey of construction buyers in the Eurozone.

Meanwhile, a similar survey in the UK has pointed to a sustained downturn in the sector there.

The latest Hamburg Commercial Bank (HCOB) Eurozone Construction PMI for August 2025 indicated that the European construction sector remains in decline, albeit the reduction in activity softened compared to July.

The seasonally adjusted index rose to 46.7 in August, from 44.7 in July (where any score below 50 indicates a decline in activity).

The index has tracked a 40-month-long decline in activity but the latest decrease was the last pronounced since February 2023.

Demand continued to be weak, with the decline in new orders decreasing in August for the 41st consecutive month. However, the pace of decline eased from the previous month. Construction buyers reported a decline in new orders in Italy, Germany and France.

Italian firms surveyed remained optimistic, with confidence about the year ahead strengthening in August. But French and German both held “strongly negative” outlooks, although French firms posted a slight recovery since July.

Norman Liebke, economist at Hamburg Commercial Bank, said, “Eurozone construction activity may be on the uprise. Construction activity declined in a rapid manner, although the pace slowed down modestly, the lowest in two-and-a-half-years. The index rose from 44.7 in July to 46.7 in August. Interestingly, the index rose especially in France and Italy, whereas Germany’s construction sector saw a sharper downturn. Civil engineering grew at a modest pace thanks to France and Italy, while housing and commercial activity remained subdued, in accordance with the three European countries.

“Housing activity is slowly but steadily recovering. Although housing drags on overall activity the strongest, its index reached its second-highest point for two-and-a-half years. Commercial activity is closer to the expansion threshold, but it seems more likely that the commercial subsector is turning down again and the housing sector increasing, following current dynamics. Civil engineering remained volatile in recent months, hopping above and below the expansion threshold. “

The outlook for the European construction sector remains gloomy...This is also reflected in the current employment situation, which does not seem to be lightening up any time soon. Accordingly, new orders remain rather sluggish, giving no cause for any sense of optimism.”

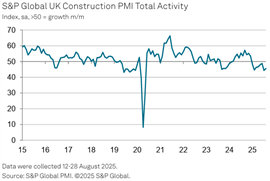

‘Sustained downturn’ in UK

In the UK, buyers reported a decline in construction activity in August, making it the eighth month in a row.

The S&P Global UK Construction Purchasing Managers’ Index (PMI) registered 45.5 in August, up from 44.3 in July.

A slower reduction in commercial building (47.8), offset steeper declines in residential (44.2) and civil engineering activity (38.1). The decline in housebuilding activity was the sharpest since February.

Total new orders also decreased for the eighth month in a row in August, although the rate of decline eased to the least marked since January. Construction buyers commented on challenging market conditions, intense price competition and headwinds from sluggish UK economic activity.

Business optimism across the UK construction sector remained weak, with 34% of the buyers surveyed predicting a rise in output over the coming year, compared to 22% forecasting a reduction – the lowest degree of confidence since December 2022.

Tim Moore, economics director at S&P Global Market Intelligence, said, “Construction activity has decreased throughout the year-to-date, which is the longest continuous downturn since early-2020. August data signalled only a partial easing in the speed of decline after output fell at the fastest pace for over five years in July.

“There were some positive signals on the supply side as vendors’ delivery times shortened, subcontractor availability improved and purchasing price inflation hit a ten-month low. However, easing supply conditions mostly reflected subdued demand and a lack of new projects.

“Elevated business uncertainty and worries about broader prospects for the UK economy meant that construction sector optimism weakened in August.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM