Read this article in Français Deutsch Italiano Português Español

Buyers report slowing decline in construction activity in Eurozone and UK

08 May 2025

Construction activity continued to decline in the Eurozone and UK in April but the rate of decline has slowed, according to new surveys of construction buyers.

Construction activity continued to decline in the Eurozone and UK in April but the rate of decline has slowed, according to new surveys of construction buyers.

The latest Hamburg Commercial Bank (HCOB) Eurozone Construction Purchasing Managers’ Index (PMI) rose from 44.8 in March to 46.0 in April (where any score lower than 50.0 indicates a contraction).

Activity has now fallen consistently for three years in the Eurozone but the latest decrease was the least pronounced since February 2023.

The slower decline reflected a softer reduction in activity in Germany, although the contraction in France strengthened slightly and activity in Italy stalled, according to the survey of buyers.

The housing sector posted the sharpest decline across the Eurozone but it was the softest reduction in 26 months. Commercial and civil engineering did contract during the month but remained “solid” overall, according to the survey.

Meanwhile, new orders fell for the 37th consecutive month but the pace of decline softened.

When it came to construction prices, inflation quickened to a 15-month high but remained considerably softer than the long-run series average.

Norman Liebke, economist at Hamburg Commercial Bank, said, “Although construction activity continued to contract in April, the pace of contraction slowed. Germany managed to push the HCOB Construction PMI Index up slightly, while France and Italy pulled it down. With current GDP growth figures of 0.4%, the construction industry is unlikely to have much to do, as it remains in recession according to the HCOB PMIs. HCOB Economics expects further interest rate cuts by the European Central Bank (ECB) in the coming months of this year, which would benefit the construction industry.”

Despite early signs that the downturn in the sector was easing, construction companies in the euro area remained pessimistic regarding the year ahead. French and German firms held negative outlooks during April, with the respective degrees of pessimism worsening compared to the previous month. Growth expectations in the Italian construction sector edged up to a seven-month high.

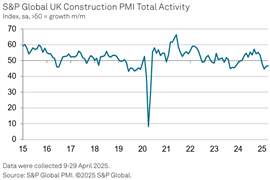

UK output slides but decline slows

In the UK, construction activity fell for the fourth consecutive month, according to construction buyers.

The S&P Global UK Construction PMI attributed the decline to rising business uncertainty leading to delayed decision making on new projects.

The index scored 46.6 in April, up very slightly from 46.4 in March.

Residential work scored 47.1 and showed some signs of resilience. On the other hand, civil engineering was the weakest-performing sub-sector, scoring 43.1, amid a lack of new work to replace completed projects.

Commercial work (45.5) decreased for the fourth month running in April, and the pace of decline accelerated to its fastest since May 2020.

Buyers also reported a steep reduction in new work in April, with the pace of decline the second-fastest since May 2020.

Tim Moore, economics director at S&P Global Market Intelligence, said: “UK construction companies have endured a bumpy ride since the start of the year as domestic economic headwinds and hesitancy among clients led to a lack of new work to replace completed contracts.

But he added, “An encouraging development in April was a slight improvement in business activity expectations for the year ahead. Output growth projections improved to the highest level so far this year, with a number of survey respondents citing the prospect of a turnaround in workloads across the residential building segment.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM