Read this article in Français Deutsch Italiano Português Español

Big spike in Belt and Road construction and investment, as strategy shifts

22 July 2025

A new report has revealed that China has just recorded higher engagement under its Belt and Road Initiative (BRI) in the first half of 2025 than in any previous six-month period.

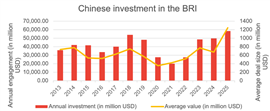

Researchers from Griffith University and the Green Finance & Development Center found that there were US$66.2 billion worth of construction contracts and $57.1 billion in investment in new projects under the BRI over the period.

Total BRI engagement now sits at $124 billion for H1 2025, edging out the full-year figure of $122 billion set in 2024.

At first glance, it’s a far cry from the pivot to “Small and Beautiful” infrastructure projects first heralded by China’s President Xi in 2021.

The average deal size for investments with a value larger than USD 100 million grew to record levels of more than $1.2 billion in 2025 (up from $672 million in 2024).

The average deal size of construction projects also increased significantly, to $783 million, up from $498 million in 2024.

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

Major African project has outsized influence

So what’s driven the increase and what does it say about the strategy behind the BRI?

First of all, a significant reason for the dramatic increase in construction engagement in H1 2025 is the $20 billion worth of contracts for the Ogidigbon Gas Revolution Industrial Park by China National Chemical Engineering.

It also helps to explain why there has been such a large increase in construction engagement in Africa (+395%) over the period, when it has declined in multiple other regions, including East Asia, Europe, Middle East and the Pacific compared to H1 2024.

Construction engagement in the Middle East was second with $19.4 billion, while Latin American BRI countries saw their lowest level of engagement in 10 years.

Five countries with highest construction volume in H1 2025:

- Nigeria: $21 billion

- Saudi Arabia: $7.2 billion

- USA: $7 billion

- Tanzania: $3.6 billion

- Indonesia: $2.1 billion

A shifting focus

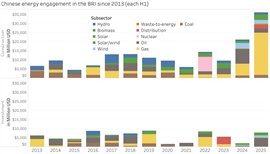

Whereas transportation infrastructure projects were a major focus of BRI construction and investment engagement under the BRI in earlier years, China has pursued a shift towards different areas.

A 2023 report by The Fudan University, a national public research university in Shanghai, China, already signalled that there would be more new contracts in the metals and mining sector under the BRI.

Most large infrastructure projects now are resource-backed deals such as oil and gas projects, the report’s author Christoph Nedopil Wang notes. In the past, there was a much larger share of fiscal spending deals like road construction projects, which presented higher financial risks to Chinese companies. Today’s resource-backed deals, on the other hand, are intended to be less risky.

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

The joint report by Griffith University and the Green Finance & Development Center confirms that engagement under the BRI in the metals and mining sector grew by $14.7 billion in H1 2025 as compared to H1 2024.

But it increased even more in the energy sector (+$20.9 billion). There was also a significant upswing in the technology sector (+$9.9 billion), focused around EV batteries and EV manufacturing plants, as well as green hydrogen development in Nigeria.

By contrast, the transport sector fell to only a 7.2% share of BRI engagement, compared to 28% in 2018.

Three countries with the highest investment volume in H1 2025:

- Kazakhstan: $23 billion

- Thailand: $7.4 billion

- Egypt: $4.8 billion

The report noted that construction deals predominate in the energy sector, while Chinese companies are prioritising equity investments in the mining and technology sectors.

China’s energy-related engagement totalled $44 billion in H1 2025, which was more than in the whole of 2024. Nearly $10 billion of that was in wind, solar and waste-to-energy projects. But there was also significant BRI engagement in oil and gas projects, which rose to just over $30 billion in just the first half of 2025.

“Chinese finance and investments into the Belt and Road Initiative countries in 2025 H1 have accelerated significantly,” said Christoph Nedopil Wang.

He said that further expansion of BRI investments and construction contracts could be possible this year. One of the drivers for that would be global economic headwinds driven by US-led tariffs.

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

Source: China Belt and Road Initiative (BRI) investment report 2025 H1 by Griffith University and the Green Finance & Development Center

Another is the need for investment to boost the green transition in China and BRI countries.

“This provides continued opportunities for mining and minerals processing deals, technology deals (e.g., EV manufacturing, battery manufacturing) and green energy (e.g., energy production and transmission).

“Furthermore, global trade volatilities and uncertainties can spur investments in supply chain resilience and exploration of new markets by Chinese companies,” he said.

But he added that the researchers nonetheless expect BRI engagement to reach lower levels in the second half of the year, with fewer “megadeals”, although deal sizes should remain higher than in 2022 and 2023 thanks to strong engagement in sectors like mining and manufacturing that require significant investment.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM