Read this article in Français Deutsch Italiano Português Español

How China is winning more construction work through the Belt and Road Initiative, as deal sizes rise

10 March 2025

Chinese companies won a total of US$70.7 billion in overseas construction contracts in 2024 via the Belt and Road Initiative (BRI), as the size of those deals increased.

That’s according to a new report produced by Griffith University in Brisbane, Australia, in collaboration with the Green Finance & Development Centre of FISF, China.

The BRI is a global infrastructure and economic development strategy launched by China more than a decade ago (in 2013). It has seen around 150 countries sign agreements to co-operate with the programme, across Asia, Africa, Europe, Latin America and the Pacific.

The report found that 2024 saw the highest BRI engagement so far, with US$70.7 billion worth of construction contracts and about $51 billion of investments.

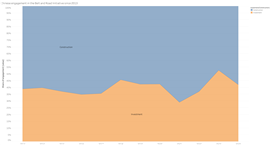

The share of Chinese engagement in the BRI through construction increased to 58% in 2024 relative to the share of engagement through investment. It was the first time that construction engagement had increased relative to investment since 2021.

Image: China Belt and Road Initiative (BRI) Investment Report 2024

Image: China Belt and Road Initiative (BRI) Investment Report 2024

Construction contracts under the BRI are typically financed through loans provided either by Chinese financial institutions or the contractors themselves, backed by guarantees from the host country’s governments, sometimes involving natural resources like oil, gas or minerals.

Meanwhile, the average deal size for construction projects under the BRI in 2024 was $498 million, according to the report. That was an increase on $394 million in 2023.

The report said that the average had been skewed by a few very large deals, such as a $1 billion oil refinery deal in Iraq, and was despite the fact that China has in recent years declared that it wanted to pursue “small but beautiful” projects through the BRI.

Shift in regional focus

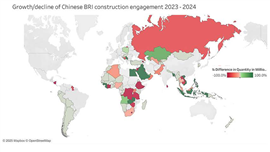

Last year also marked a significant shift in China’s focus when it came to construction engagement.

A 102% increase in engagement in the Middle East propelled the region to becoming China’s most important partner, with a total engagement of $39 billion.

Africa dropped to second place with $29.2 billion worth of engagement, which represented 34% growth on the previous year.

Engagement in Southeast Asia grew by 7% to $25.1 billion. But it fell by 64% in South Asia.

The country with the single highest construction volume in 2024 was Saudi Arabia, with about $18.9 billion, up from $5.9 billion in 2023. That was followed by Iraq with $9 billion, and Liberia at $3 billion.

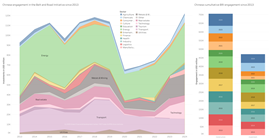

The high levels of construction volume for processing facilities in Saudi Arabia and Iraq also helped to explain how oil and gas engagement through the BRI surged to record highs of about $24.3 billion during the year.

Image: China Belt and Road Initiative (BRI) Investment Report 2024

Image: China Belt and Road Initiative (BRI) Investment Report 2024

The value of ‘green’ energy projects (solar and wind) and hydropower construction projects in 2024 increased to $10 billion, from $6.4 billion the year before.

Chinese engagement in transportation projects, which have been core to the BRI since its inception, remained steady at $15 billion. The figure was accounted for almost exclusively by construction contracts, according to the report. But it is about half what it was during the peak years of 2018 and 2019.

A total of 72 countries around the world saw some form of construction engagement through the BRI in 2024.

The Chinese companies that featured most prominently in construction projects under the BRI in 2024 were PowerChina, China National Chemical Engineering, and China Petroleum and Chemical (Sinopec).

The report’s author, Dr. Christoph Nedopil, said that further expansion of BRI investment and construction contracts seemed possible in 2025.

He said, “We do expect Chinese BRI engagement to reach similar levels in 2025 as in 2024. Part of this expectation is driven by the growing need of China’s domestic players to invest abroad to seek opportunities in other countries.

“In line with our previous predictions, we continue to see deal numbers increasing. With strong engagement in sectors requiring significant investment (for example, mining and manufacturing), compared to sectors with variable engagement (for example, renewable energy), we can expect deal size to also remain larger than in 2022 and 2023, and possibly compared to 2024.”

BRI engagement by sector over time (Image: China Belt and Road Initiative (BRI) Investment Report 2024)

BRI engagement by sector over time (Image: China Belt and Road Initiative (BRI) Investment Report 2024)

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM