Read this article in 中文 Français Deutsch Italiano Português Español

Eurozone construction buyers report accelerating downturn in September

06 October 2025

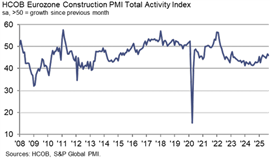

The downturn in construction activity worsened in September, according to a regular survey of construction buyers.

The Hamburg Commercial Bank (HCOB) Eurozone Construction Purchasing Managers PMI Total Activity Index fell from 46.7 in August to 46.0 in September (where any score below 50.0 indicates a contraction in activity).

It found that there was a steeper reduction in France, while activity in Germany also continued to decline. Buyers in Italy also reported a fractional fall in activity in September.

The survey also showed a decline in activity across all three monitored sub-sectors of the construction industry.

Housing activity was the worst performer, with the rate of reduction the most pronounced in three months. The commercial segment witnessed its strongest drop since November 2024, while civil engineering declined only modestly, having risen in June and August.

Meanwhile, buyers reported a sharp decline in new orders in September. French companies saw the sharpest drop, while there was also a marked downturn in Germany. But Italian companies reported a rise in new orders for the first time in three months.

Nils Müller, junior economist at Hamburg Commercial Bank, said:, “Business sentiment across the eurozone construction sector remained subdued, with confidence falling to its lowest level since January. French firms were the most pessimistic, while Italian companies showed the least negative outlook. Overall, the sector continues to face headwinds from weak demand, rising costs and deteriorating supply conditions, suggesting little near-term relief for construction activity across the eurozone.”

UK output falls – but at a slower pace

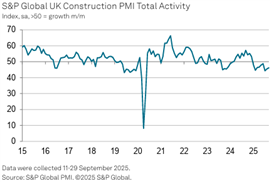

In the UK, buyers reported another downturn in activity in September but at the slowest pace for three months.

The S&P Global UK Construction Purchasing Managers’ Index recorded a score of 46.2 in September, up from 45.5 in August. However, it still marked the ninth consecutive month of a decline in activity.

Civil engineering (42.9) was the weakest-performing sector although activity decreased at a faster rate than in August. There was also a weaker fall in residential construction (46.8). Commercial construction (46.4) was the only segment to see a faster rate of decline in September.

Buyers also reported a decline in order books in September and often noted that subdued demand and elevated business uncertainty made it difficult to convert sales opportunities.

Tim Moore, economics director at S&P Global Market Intelligence, said, “”Business activity expectations for the year ahead were among the lowest since the end of 2022, suggesting that construction companies remained cautious about the near-term outlook and have yet to see a turning point on the horizon. Some firms hope for a boost from lower borrowing costs and noted new sales pipelines in areas such as energy security markets and infrastructure projects. However, many survey respondents reported caution among clients ahead of the Autumn Budget and a general reluctance to commit to major capital expenditure projects against a subdued domestic economic backdrop.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM