Read this article in Français Deutsch Italiano Português Español

European construction is in a slump. What needs to happen to escape it?

09 September 2024

View of a building site with diggers and assorted construction equipment in a residential area of Wildberg in Baden-Wuerttemberg, Germany. (Image: joerghartmannphoto via AdobeStock - stock.adobe.com)

View of a building site with diggers and assorted construction equipment in a residential area of Wildberg in Baden-Wuerttemberg, Germany. (Image: joerghartmannphoto via AdobeStock - stock.adobe.com)

Europe’s construction sector is in the grip of what economists have called a “broad-based decline”.

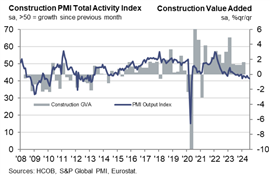

Figures released last month by the Hamburg Commercial Bank (HCOB) Purchasing Managers’ Index showed that activity was down in the Eurozone as a whole, as well as in the major economies of Germany, France and Italy. In Europe as a whole, activity has now been in decline for 28 months straight.

In the case of Germany, the HCOB PMI shows that activity in the country has been in negative territory for more than two years. In France, activity has also continued on a broadly downward trajectory since 2022.

So what needs to happen before Europe’s construction sector can arrest the slump and return to growth territory?

The causes

First of all, it’s worth acknowledging that not all sub-sectors of the industry are equal, as far as their performance is concerned.

“It is definitely true that that these confidence indicators are still in negative territory,” says Maurice van der Sante, senior economist construction at Dutch bank ING. “We have to acknowledge that it’s mainly the new residential sector has been hit and many other sectors are doing surprisingly well.”

Van der Sante makes the point that given strong demand for housing in Europe it is somewhat strange that the environment for new residential building projects remains so tough. But strong inflation in building materials costs and increased interest rates following the Covid-19 pandemic and the outbreak of war in Ukraine in 2022 have conspired to make it much for difficult to make projects profitable.

Germany remains a particularly difficult market. Building permits for housing now sit at their lowest level for 14 years. “From a housing policy perspective, the first half of the year was another major disappointment,” says Tim Oliver Müller, managing director of the Federation of the German Construction Industry, Bauindustrie.

“We are heading for the weakest level of approvals since 2010. This is cementing the housing shortage in conurbations and their surrounding areas, as well as in many regional centres. In June, the number of approved dwellings continued to fall by double digits for the 21st time in a row,” he added.

Worryingly, Müller warns that there is still “no hope of a recovery in sight”.

Meanwhile, the HCOB France Construction PMI for August showed that housing construction has fallen at one of the fastest rates on record, while commercial building work has also dropped. That has dragged overall construction activity levels down at the fastest rate since January.

“Official data shows that, in 2023, housing starts fall close to their lowest historical level and could fall below that in 2024, according to the collapse of permits and housing sales,” Loïc Chapeaux, directeur of economic and international affairs for France’s construction association Fédération Française du Bâtiment (FFB) tells Construction Briefing.

The decline concerns all forms of housebuilding, whether it is public or private, for rentals or sale, individual housing and or apartments, and in urban or rural areas, Chapeaux explains.

“This crisis results from three kind of factors: tighter and more expensive credit markets of course, just like in the whole Euro area; an increase of production prices caused both by the aftermath of the Covid-19 crisis and by stricter building regulations; and a continuous reduction of French public subsidies dedicated to housing sector since 2017,” he adds.

Meanwhile, the HCOB Italy Construction PMI for August also showed a decline in activity for the fifth month in a row, with residential construction the weakest-performing sub-sector. Construction companies expressed weak optimism for the future, although confidence levels were at their lowest for two years, according to the survey.

Fortunately, in other parts of Europe there are signs of recovery. After two years of decline the issuance of EU building permits for new-build houses has been rising since the third quarter of 2023 and increased by 6.6% in the final quarter of last year and by 1.5% in the first quarter of 2024, according to ING analysis. Spain, Poland and the Netherlands are all seeing good rates of recovery, even if the picture is more sluggish in France and Germany.

Stronger performance from non-residential construction

While the residential market may be struggling, France’s Fédération Nationale des Travaux Publics (FNTP), which represents contractors undertaking work in the public sector, points out that the picture for its members has been much more positive.

“In 2024, public works activity in France held up well in the face of the crisis affecting other construction segments, such as residential construction. In fact, public works output rose by 2.3% in the first half of the year (in current euros), while order intake continued to be buoyed by the award of major contracts,” says a spokesperson for the FNTP. Among the projects they mentioned as examples were the huge Grand Paris Express scheme, the Lyon-Turin railway, tramway and energy projects.

Major projects like the Lyon-Turin railway, which includes the 65km-long Mont Cenis Base Tunnel, have buoyed non-residential construction in France. (Photo: Herrenknecht)

Major projects like the Lyon-Turin railway, which includes the 65km-long Mont Cenis Base Tunnel, have buoyed non-residential construction in France. (Photo: Herrenknecht)

For his part, van der Sante is “amazed” that the non-residential construction has held up as well as it has during Europe’s economic downturn over the past two years. “Normally when there is now economic growth, companies are more reluctant to invest in new premises. But those levels kept up pretty well and there has also been healthy public investment in things like schools and healthcare,” he says.

Light at the end of the tunnel?

While the overall activity figures in Europe look rather gloomy, van der Sante sees cause for optimism in Europe as a whole. “I see a light at the end of the tunnel. Production volumes [of building materials] are bottoming out. There has been a decline in the European Union of 15-20%, which is of course huge, but it is slowly beginning to track upwards again. It’s not very convincing yet, but the first signs are there,” he says.

He also points to increasing house prices in the Netherlands which had declined sharply but are now back to the levels they were two to three years ago. “That is a good sign for new building construction but it always takes some time before contractors seen an increase in their production,” he adds.

As a result, ING expects Europe to witness a continued decline in activity in 2024 but then forecasts a small increase in 2025.

And there are early signs that confidence in the sector is starting to improve. The latest figures from European Commission’s Economic Sentiment Indicator (ESI) registered a small improvement in construction in July 2024 (see chart below).

Setting the conditions for growth

Nonetheless, Germany’s Bauindustrie believes that there are actions that both the government there and authorities at the European level can take to help revive construction’s fortunes.

Remarking that one particular problem in Germany is a stubborn sense of pessimism regarding the economic situation, a spokesman for Bauindustrie says, “I think in general everyone is waiting for the European Central Bank (ECB) to lower the interest rates and see what effect it has on housing.”

That’s likely to happen in the autumn but it’s far from the only action that could make a positive difference says Müller, who is calling for the government to reduce the burden of bureaucracy and complexity that the industry currently bears.

“The will of politicians to turn the tide is recognisable. In addition to sufficient funding, however, the liberating blow must be sought in a reduction of the almost endless demands on our residential buildings. Without a radical cut in construction-cost-driving requirements from the federal, state and local governments, nothing will change and new negative records will be set month after month,” Müller adds.

A building site in Germany (Image: Jakob Kamender via AdobeStock - stock.adobe.com)

A building site in Germany (Image: Jakob Kamender via AdobeStock - stock.adobe.com)

These complexities can range from rules on noise insulation and ensuring that there are car parking spaces adjacent to buildings, down to specifying the number power points a building should have, their energy efficiency and more, a spokesperson explains. “Some can be considered as a little luxurious but not necessary for functionality and safety,” the spokesperson adds.

For his part, Chapeaux acknowledges that the volume of real estate loans has been gradually recovering in France since March 2024. He would still like to see a further reduction of ECB rates but thinks there are other actions that can be undertaken at the national level.

“For instance, the French High Council for Financial Stability has defined, since 2021, binding rules for the credit market that contributes to the blockage of the home-ownership market. Yet, there is no evidence of any significant risk on housing loans in France since the mid-1990s,” he points out.

Van der Sante does not expect a reduction in interest rates by the ECB to make a difference in the short term at least. “It always takes a while before companies start to expand their real estate [after a fall in interest rates],” he says.

But he also cautions on getting too hung up on residential construction. “I always call renovation the forgotten sector of construction. When we think about construction we think about fancy new buildings but about 50% of the total production within construction is renovation and maintenance work, which is always less vulnerable to economic cycles.

“We are also in an energy transition and buildings need to be insulated, heat pumps need to be installed. We can get carried away with the idea that just because things are not good in the new residential market, that doesn’t mean it is bad news for the construction sector as a whole.”

Even here, Chapeaux is concerned that in France, the renovation market is heading towards stagnation because French household spending is constrained.

He wants action at the European level to develop a long-term strategy for construction that takes the energy transition as well as housing needs into account, with a view to steering public and private investment towards construction and renovation.

“The forthcoming appointment of the first EU Commissioner for Housing as announced by Ursula von der Leyen constitutes a good start. However, since housing is not an EU competence, European authorities must ensure not to create more regulations and administrative burden that may lead to higher construction prices. Actually, the FFB asks for a moratorium on European regulations and construction standards, which have multiplied during the former mandate 2019-2024 with the EU Green deal,” he says.

On the French national level, the FFB wants a coherent and stable housing policy. “According to official data, taxes return on housing are 2.4 times higher than housing subsidies since 2020, which is an historic high,” he says. “Thus, budgetary room for manoeuvre should be found. For example, FFB has calculated that each zero-interest loan granted leads to a return on investment of €25,000 for the national budget after five years. A broader zero-rate loan (for all types of housing, throughout the country) would boost first-time homebuyers, while generating public revenue,” he argues.

Keeping non-residential construction strong

Meanwhile, the continued strength of non-residential construction should not be taken for granted, as the FNTP highlights.

It warns that political instability can put public investment in construction projects at risk. With reference to France, a spokesperson said, “In the medium term, the economic and social repercussions of the political instability following the dissolution of the French National Assembly are a source of uncertainty. Public measures to provide visibility for the sector are therefore needed.”

To that end, the European Construction Federation (FIEC), of which the FNTP is a member, set out 10 key messages ahead of the European Elections this year to help build a resilient and sustainable construction industry in Europe.

The FNTP has zeroed in on two particular areas that it regards as priorities: assuring a quality, decarbonised infrastructure network; and, in common with its German counterpart Bauindustrie, lightening the regulatory burden.

Among the measures it has called for are an ambitious financial framework to support low-carbon infrastructure construction and investment in infrastructure maintenance. It also wants to see legislation governing construction simplified and an effort to produce standards that meet business needs.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM