Read this article in French German Italian Portuguese Spanish

Eurozone construction activity down sharply amid continued housebuilding woes

09 September 2024

A residential housing project in the Netherlands under construction. European construction activities are contracting, particularly on weak growth in the new housing sector. (Image: Adobe Stock)

A residential housing project in the Netherlands under construction. European construction activities are contracting, particularly on weak growth in the new housing sector. (Image: Adobe Stock)

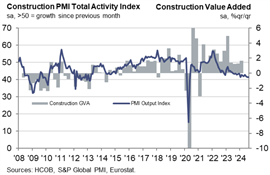

Construction activity in the Eurozone fell sharply in August, as the dragged down by continued tough conditions in the residential subsector.

The latest Hamburg Commercial Bank (HCOB) purchasing managers’ index (PMI), which surveys construction buyers across the Eurozone, recorded a score of 41.4.

Any score lower than 50.0 indicates a decline in activity, whereas anything above that mark indicates an increase.

The HCOB PMI for the Eurozone has now registered a decline in activity for each of the last 28 months and 41.4 was the same score as recorded in July.

Housing posted the sharpest decline, with the steepest reduction in activity since April 2020. Commercial activity also fell sharply in August, while the rate of decline was slowest in civil engineering was the slowest, although still relatively steep.

Meanwhile, the purchasing managers surveyed reported a decline in new orders for the 29th consecutive month. The pace of decline eased as compared to July but “remained substantial” according to the survey.

Staffing levels at construction businesses fell for the 18th consecutive months at a pace little changed from July and the overall reduction in workforce numbers was centred on Germany, where the decrease was the strongest since May.

Suppliers’ delivery times shortened in the Eurozone for the fifth consecutive month as a result of weaker demand for inputs. French vendors reported the most marked improvement in performance since December 2017, while there was a sharp improvement in Germany too. Italian vendors saw lead times shorten for the first time since October 2012.

HCOB Eurozone PMI to August 2024 (Source: HCOB/S&P Global)

HCOB Eurozone PMI to August 2024 (Source: HCOB/S&P Global)

Use of subcontractors in the Eurozone contracted at the steepest rate since April 2020 and the rates they charge increased only marginally, at their softest rate to date in 2024.

Dr Tariq Chaudhry, economist at Hamburg Commercial Bank, said, “The crisis in the European construction sector shows no signs of abating. The HCOB PMI remained stagnant in August at 41.4 points, indicating a continued contraction.

“The particularly weak performance of the largest economies in the Eurozone—Germany and France—weighs heavily on the index. Especially the housing sector presents a troubling trend. With the construction sector remaining sluggish, pressure is mounting on the European Central Bank (ECB) to counteract with interest rate cuts, especially as inflation in the Eurozone came in at 2.2% year-on-year in August, nearing the ECB’s target rate.

“Rising prices continue to be a significant issue for the European construction sector. Despite weak demand, input costs are still on the rise and even accelerated in August. While input costs in Germany saw a slight decline, construction firms in France and Italy reported significantly higher costs, largely attributed to increasing raw material prices.

“European construction firms are looking to the future with skepticism. Although new orders and purchasing volumes have seen a slight improvement compared to the previous month, the contraction in these sub-indices remains pronounced. Business expectations for the next twelve months are deeply negative, falling well below the historical average. Consequently, employment in the sector continues to decline.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM