Read this article in Français Deutsch Italiano Português Español

Can small modular reactors finally spark a new phase of nuclear construction?

29 July 2025

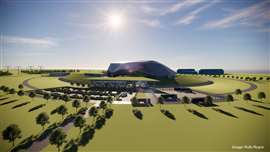

A digital image of how the GE Vernova Hitachi BWRX-300 SMR in Darlington, Ontario, Canada could look (Image: GE Vernova Hitachi)

A digital image of how the GE Vernova Hitachi BWRX-300 SMR in Darlington, Ontario, Canada could look (Image: GE Vernova Hitachi)

It has felt like a long wait for small modular nuclear reactors (SMRs) and the wave of construction projects they promise to bring with them.

Long anticipated, very few projects have made it past grade statements of ambition or vague agreements.

While nuclear developers have promoted SMRs’ potential to cut emissions, reduce costs, and enhance energy security, the reality has been a succession of delays, regulatory hurdles and the prospects of costs so high that project backers have balked. But that may now be starting to change.

Recent momentum among SMR developers like GE Vernova-Hitachi, Rolls-Royce SMR and Samsung C&T has started to shift the mood. So too has the emergence of a new and unexpected power-hungry customer: technology firms building vast data centres to support artificial intelligence (AI).

Governments, meanwhile, are responding. The UK’s Department for Energy Security and Net Zero recently awarded preferred bidder status and funding to Rolls-Royce SMR to build the UK’s first reactor.

Rendering of how a Rolls-Royce SMR could look (Image: Rolls-Royce)

Rendering of how a Rolls-Royce SMR could look (Image: Rolls-Royce)

Canada’s government, through Ontario Power Generation, has pushed ahead with site development for four BWRX-300 reactors at Darlington, east of Toronto.

And Romania is aiming to deploy one of the first European SMRs using modular construction methods.

These signs of progress signal potential opportunities in civil engineering, modular fabrication, site assembly, and replication across borders. But obstacles remain, and it is still too early to tell whether SMRs will deliver on their promises.

From high hopes to hard lessons

One of the clearest examples of the challenges SMRs have faced is the failure of the Carbon Free Power Project (CFPP) in Idaho. The project, led by NuScale Power, was to consist of six 77MW modules based on its pressurised light water design. Despite regulatory approval and significant federal funding, the scheme collapsed in November 2023 amid escalating construction costs and a lack of buyer commitment.

The project’s total price tag had risen from US$3.6bn to over US$9bn, pricing its power out of reach for municipal buyers. The cancellation was a major blow to hopes for a new generation of factory-built reactors.

Tony Roulstone, senior lecturer at Cambridge University and an expert in nuclear energy, says the NuScale episode illustrates the importance of achieving economies of scale. “If you get trapped into just building the odd one here and the odd one there, then you build them in a conventional way and they’ll cost more than large reactors and so the whole purpose behind them will be lost,” he says.

GE Vernova Hitachi and Rolls-Royce: Leading the next wave?

Today, attention is focused on other players. In addition to progressing reactors at Darlington in Canada, GE Vernova Hitachi has also seen interest in Saskatchewan, Poland, and from the Tennessee Valley Authority in the US, according to Roulstone.

Rolls-Royce SMR has secured preferred bidder status from Great British Energy in the UK to build an SMR on as-yet-unidentified site and is progressing through the final stages of the UK’s generic design assessment process. But the UK government has previously said it wants to build one of Europe’s first SMR “fleets”. Where other SMRs could be built is not yet clear but they are likely to occupy former industrial sites, such as former nuclear plants, or old coal mines close to the grid.

“They [Rolls-Royce] always said that they wouldn’t do it in the UK unless they could do 15,” Roulstone notes. “They’re not announced, but there’s a less firm form of order book for more than one in the UK.”

Rolls-Royce has also signed agreements in the Czech Republic and is attracting interest from Sweden, the Netherlands and Turkey.

Samsung C&T highlights modular approach

Meanwhile, Samsung Construction & Technology (C&T) has made moves to enter the European market, signing memorandums of understanding in Romania and Estonia. In June 2025, its engineering and construction (E&C) group showed off a steel-composite modular wall for SMR construction that it has developed in collaboration with Japanese heavy industry company IHI Corporation.

Representatives from RoPower, a subsidiary of Romania’s SMR project developer Societatea Nationala Nuclearelectrica (SNN), US-based contractor Fluor and SMR firm NuScale all attended a ceremony in Japan for the module demonstration.

Samsung C&T’s steel composite module mockup at a completion ceremony at IHI’s Yokohama plant in Japan (Image courtesy of Samsung C&T)

Samsung C&T’s steel composite module mockup at a completion ceremony at IHI’s Yokohama plant in Japan (Image courtesy of Samsung C&T)

Samsung C&T E&C Group is currently participating in the Front-End Engineering Design (FEED) phase of Romania’s SMR project. After demonstrating its modular construction method, the company is now expected to take on a major role in the main construction phase

So far, it’s not clear when construction on the Romanian and Estonian projects would start but Koo Won-seok, executive vice president of Samsung C&T’s Nuclear Business Team, said the company wants to strengthen its competitive edge in what he called the “rapidly growing SMR market”.

“The successful demonstration of the SC module further proves our technical expertise and project execution capabilities in the SMR construction sector. Building on this success, we aim to ensure the successful delivery of the Romania SMR project,” he said.

AI drives new demand

Another catalyst for SMRs has come from the technology sector. Roulstone points to a surge in interest from companies like Microsoft, Meta, Amazon and OpenAI. Meanwhile, US contractor Bechtel last year broke ground on a $4 billion advanced nuclear reactor for TerraPower, co-founded by Bill Gates, in Reston, Virginia, that uses sodium instead of water as a coolant.

“There’s been announcements by Meta and Amazon and OpenAI for what we’d call AMRs,” Roulstone says, referring to advanced modular reactors. “And of course there’s [Bill Gates’s] natrium reactor, which are technologically less mature, but they are getting big investments and those investments will move them on in some sort of way.”

A rendering of the completed Natrium plant. Image: TerraPower

A rendering of the completed Natrium plant. Image: TerraPower

Big tech’s interest is driven not by cost but by speed, control, and the need for vast, reliable, low-carbon power.

“They want it quickly and they want something which is a few hundred megawatts. They don’t want to wait for 15 years to build another Vogtle,” Roulstone says, referring to the Vogtle Electric Generating Plant in Georgia, USA, where construction of two new AP1000 reactors suffered lengthy delays and has overshot its original budget of $14 million by an estimated £20 billion. “Utilities just want the lowest-cost power. The AI people said they want power they can depend on and they want it under their control,” adds Roulstone.

Several firms are now investing directly in SMR ventures. Microsoft has signed a 20-year deal with Constellation to power its data centres with nuclear. Amazon is backing X-Energy and has agreed to take power from the Susquehanna plant in Pennsylvania, as well as looking into building new data centres. Google has signed partnerships with advanced SMR developers including Kairos Power.

In many cases, these projects aim to deliver dedicated, behind-the-meter power, bypassing the grid entirely. That could make nuclear construction more attractive, but it also presents regulatory and planning challenges.

Overcoming regulatory risk

Roulstone warns that national regulators remain a key obstacle to replicable construction.

“If you have the business where each time you build something in another country, they want to change the design, I think this threatens the fundamental aspect of SMRs,” he says.

He cites the UK’s treatment of large reactor designs as an example, where regulators demanded changes to the EPR reactor used at Hinkley Point C, the advanced boiling water reactor, and the Westinghouse AP1000.

“I’m not complaining about them having high safety standards. It’s just changing their mind or messing about with the design,” he adds, noting that this slows down construction and increases costs.

Barakah nuclear power plant under construction in the United Arab Emirates (Image: wikiemirati via Wikimedia Commons)

Barakah nuclear power plant under construction in the United Arab Emirates (Image: wikiemirati via Wikimedia Commons)

By contrast, the Barakah plant in the United Arab Emirates, built by a consortium led by Korea Electric Power Corporation (KEPCO) was a success in part because of regulatory restraint. “The regulator accepted Korean stuff with some oversight from other people. And they essentially said: ‘This is a good design, so why would we fiddle with it?’,” he says.

Should this new wave of SMR projects proceed, then contractors could benefit from a new category of nuclear construction that is smaller in scale but higher in repeatability.

But Roulstone is cautious for the time being about whether such plants will prove a rich source of new construction work because project costs are still very high. “They did publish a cost for the project at Darlington: $20 billion for 1.2GW. It is very expensive. It’s as expensive as a large reactor,” he says.

As ever then, success will depend on delivery. Without an order book, stable regulation, and credible construction models, SMRs risk repeating the mistakes of the past.

Still, there is evidence that this time might be different. “The balance of arguments are changing in the last few years,” Roulstone says. “Security of supply is becoming much more important. Climate change is becoming much more significant.”

For construction firms, the message is clear: now may be the time to start preparing for the SMR market but with eyes open to the risks as well as the potential.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM