Read this article in 中文 Français Deutsch Italiano Português Español

US non-residential construction spending went negative prior to government shutdown

17 November 2025

A freeway under construction in downtown Birmingham, Alabama, USA (Image: Zenstratus via AdobeStock)

A freeway under construction in downtown Birmingham, Alabama, USA (Image: Zenstratus via AdobeStock)

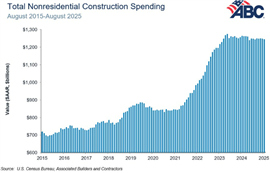

US non-residential construction spending tipped into negative territory in August, prior to a record government shutdown, according to newly released data.

Associated Builders and Contractors (ABC) said non-residential spending dipped 0.2% in August compared to the previous month, according to its analysis of US Census Bureau figures whose release has been delayed by the 43-day shutdown.

On a seasonally adjusted annualised basis, non-residential spending totalled $1.24 trillion, according to ABC.

Spending fell on a monthly basis in 10 of the 16 non-residential subcategories, albeit from levels that recently stood at record highs. Private non-residential spending was down 0.3%, while public non-residential construction spending was down 0.1% in August.

On an annual basis, non-residential construction spending was -1.8% in August 2025, compared the the same period in 2024.

Residential spending increased 0.8% on a monthly basis but was down 1.8% on an annual basis.

ABC chief economist Anirban Basu said, “Non-residential construction spending contracted for the third time in the past four months in August and is now down 1.5% year over year.

“The manufacturing and commercial categories have been particularly weak in 2025, while momentum remains confined almost exclusively to the data centre segment. This should come as no surprise given that approximately 1 in 7 ABC members are under contract to work on a data centre, and those contractors have significantly higher backlog than those that are not, according to ABC’s Construction Backlog Indicator survey.”

Basu noted that the August data did not reflect the effect of the shutdown nor the “cost-raising potential” of tariffs that there implemented at the start of that month.

“With private non-residential activity buckling under the weight of high borrowing costs, extraordinarily elevated uncertainty and rising materials costs, a slowdown in public sector work could lead to a particularly difficult few quarters for the industry,” he added.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM