Read this article in French German Italian Portuguese Spanish

Difficult times for France’s construction sector as Intermat returns

19 April 2024

Image: beatrice prève via AdobeStock - stock.adobe.com

Image: beatrice prève via AdobeStock - stock.adobe.com

Paris, dubbed the City of Light, hosts the Intermat construction show this week (24-27 April) after a six-year-long absence.

Fittingly, the show at the Paris-Nord Villepinte convention centre, is a bright spot for both France’s construction industry and the wider European market, in a year that sees the French capital host the Olympic Games.

Despite some initial scepticism that it would struggle to reach the 1,000 exhibitors it was aiming for, Intermat announced earlier this month that it has met that target.

But the first show since 2018 (the 2021 event was cancelled due to the Covid-19 pandemic) is set against a difficult economic backdrop for the French construction industry.

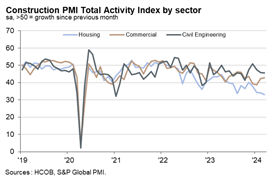

Construction buyers in France reported another slump in activity in March, according to the latest HCOB France Construction Purchasing Managers’ Index (PMI), dropping to a score of 41.0, down from 41.9 in February.

That signals a faster rate of decline in activity in the country (a score of 50.0 on the index indicates no change) and extends the period that the index has been in negative territory to 22 months.

All three forms of construction that the index monitors – housing, commercial and civil engineering – registered a decline. But it has been particularly acute in the residential sector, which saw its fastest fall in output since November 2014, if you discount the months of the pandemic in 2020.

’90,000 jobs at risk’

Last month, the Fédération Française du Bâtiment (FFB) warned that 90,000 construction jobs in France are at risk in 2024 as a result of the sector’s decline. It referred to official figures that saw housing construction starts drop by 5% in 2022, then 24% in 2023, and again by 23% year-on-year over the three months to the end of January 2024.

The FFB said the figures confirmed its forecast of a “real crash” in 2024, with only eight housing starts per 1,000 households in France, a level comparable to the post-war years of the early 1950s.

“The only good news” as far as the FFB was concerned was that the cost of materials and energy are generally stabilising.

But it urged the French government to offer more support to the repair and maintenance sector by simplifying and widening access to residential renovation grants via schemes like MaPrimeRénov and MaPrimeAdapt, as well as the school renovation programme (EduRénov). And it called for a relaxation of lending rules as the credit markets ease, to stimulate the housing market.

Major rail contracts boost public projects

When it comes to public projects, members of the Fédération Nationale des Travaux Publics (FNTP), which represents 8,000 companies in the sector, struck a more positive tone at the start of the year.

In January this year, they professed themselves to be significantly more optimistic on their planned activity than they had been in October 2023.

But by February, that optimism had been tempered somewhat as public works continued on a slightly downward trend. Activity during the month fell by 1% in February as compared to the month before and by 0.8% year on year.

The association warned, “The confidence expressed by public works contractors at the start of the year must now be qualified, particularly given a budgetary constraint that is greater than anticipated on the part of the Departments and the state.”

Nonetheless, one strong area for public projects was in rail, where order intake in February 2024 by 20.7% compared to the same month a year before. That was driven by the award by the France’s national rail operator SNCF for a series of multi-year contracts to regenerate the network.

Both Eiffage and Vinci last month announced contract wins worth hundreds of millions of Euros under the programme.

‘Pessimistic outlook’

However, taking the construction sector as a whole, it’s hard to sugarcoat the situation.

The latest HCOB France Construction PMI warned that following a further shrinking of order book volumes in March and new projects received by French builders falling at a faster rate for a third month running, construction companies have a “pessimistic outlook” for the next 12 months.

It warned of downbeat expectations for the real estate sector, inflation, and sustained weakness in demand.

Norman Liebke, economist at Hamburg Commercial Bank, said, “The French construction sector ends the first quarter of 2024 on a bad note. Activity declined sharply for another month with new orders, the employment situation and subcontractor quality worsening.

“Accordingly, companies are more pessimistic about the future compared to the previous month.”

He forecast that the downturn would last into the second quarter, with a “broad-based” recession in the sector.

“Although activity in all three sectors – housing, commercial and civil engineering – fell further in March, the decline was more pronounced in the residential sector. A staggering 47% of respondents reported a decline in housing activity while only 9% noted an uptick in activity,” he added.

The organisers and exhibitors at Intermat will be hoping that this week’s show will help to cast a more positive light on the sector, as they show off innovations aimed at supporting French and indeed European construction, in building a brighter future.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM