Who is building small modular reactors and how long will it take?

20 March 2023

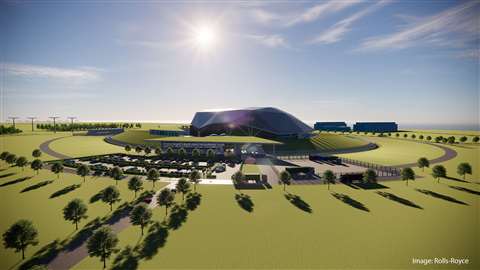

Rendering of how a Rolls-Royce SMR could look (Image: Rolls-Royce)

Rendering of how a Rolls-Royce SMR could look (Image: Rolls-Royce)

Nuclear power is making a comeback amid the global energy crisis and the drive towards net zero.

A new generation of land-based small modular reactors (SMRs), typically produce 300MWe or less.

Originally adapted from technology in nuclear submaries and nuclear aicraft carriers, SMRs for civil power generation promise shorter construction times thanks to factory fabrication of standardised, off-the-shelf components.

They are also attractive because their smaller footprint means that they could fit onto the site of decommissioned coal-fired power plants and other brownfield sites.

At the end of 2022, Balfour Beatty signed a new alliance to build SMRs in the UK for US-based Holtec.

But so far, only one or two land-based SMRs are under construction, although several companies are working on their development and deployment:

SMRs under development and construction

1) China

China has already constructed a prototype high-temperature gas-cooled pebble-bed (HTR-PM) 200MWe SMR at the Shidaowan site in Shandong province.

China’s ‘Linglong-1’ SMR under construction (Image: CNNC)

China’s ‘Linglong-1’ SMR under construction (Image: CNNC)

Construction of the world’s first commercial, land-based SMR, “Linglong-1”, started on the island of Hainan in 2021.

China National Nuclear Corporation (CNNC) will be owner and operator of Linglong-1, based at the Changjiang nuclear plant, which already houses two reactors.

The Nuclear Power Institute of China has designed the reactor and contractor China Nuclear Power Engineering Group is building the plant.

The new SMR, housing a 100MWe ACP100 pressurised water reactor (PWR), is due for completion in 2026.

2) US

NuScale Power’s Voygr SMR design, consisting of six 77Mwe modules, is the first to win certification from the US Nuclear Regulation Commission.

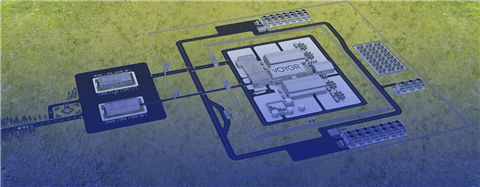

A rendering of a NuScale Power Voygr SMR plant (Image courtesy of NuScale Power)

A rendering of a NuScale Power Voygr SMR plant (Image courtesy of NuScale Power)

NuScale plans the first commercial construction of a Voygr plant at the Carbon Free Power Project (CFPP) at the Idaho National Lab.

Holtec International is developing the 160MWe SMR-160 PWR modular reactor, which it hopes to start building by the late 2020s and has signed a deal with Hyundai for the supply of a standard design worldwide.

TerraPower and GE Hitachi Nuclear Energy are developing a 345MWe ‘Natrium’ reactor, combining a sodium fast reactor with a molten salt energy storage system. They are building a demonstration plant in Kemmerer, Wyoming, on the site of a retiring PacificCorp coal plant.

Kairos Power is developing the Hermes Reduced-Scale Test Reactor, a scaled-down version of its fluoride salt-cooled high temperature reactor (KP-FHR). It aims to build the Hermes demonstration reactor at the East Tennessee Technology Park by 2026.

Maryland-based X-energy is working to licence its XE-100 high-temperature gas-cooled reactor (HTGR).

3) UK

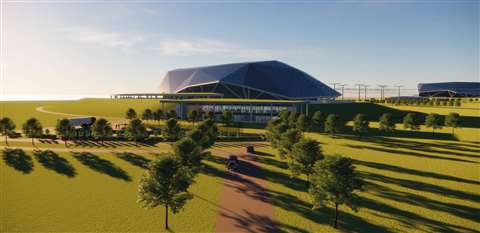

A rendering of how a Rolls-Royce SMR could look (Image courtesy of Rolls Royce)

A rendering of how a Rolls-Royce SMR could look (Image courtesy of Rolls Royce)

Rolls-Royce has entered the Generic Design Assessment (GDA) process with the Office for Nuclear Regulation for its 470MWe PWR SMR design.

Rolls-Royce is leading a consortium of UK-based companies, including BAM Nuttall and Laing O’Rourke, to build its first SMR in the UK by 2029.

In the UK’s March Budget, Chancellor Jeremy Hunt announced the launch of a new competition to build the UK’s first SMRs, with the aim of attracting designs from domestic and international manufacturers.

The government has plans to match a proportion of private investment with public money to deploy the winning design more quickly.

4) Canada

General Electric Hitachi Nuclear Energy (GEH) is developing the BWRX-300, a 300MWe water-cooled SMR.

A rendering of how a General Electric Hitachi BWRX-300 SMR plant could look (Image courtesy of GE Hitachi Nuclear Energy)

A rendering of how a General Electric Hitachi BWRX-300 SMR plant could look (Image courtesy of GE Hitachi Nuclear Energy)

Ontario Power Generation (OPG) has selected it to build a BWRX-300 at its Darlington site as early as 2028. GEH has also applied to have the design of the BWRX-300 assessed in the UK.

It is also looking at deploying the reactors elsewhere in the world in joint ventures, including the construction of 10 reactors in Poland in the early 2030s, as well as potentially in Sweden.

Terrestrial Energy is developing its Integral Molten Salt Reactor (IMSR) Generation IV SMR for commercial deployment from 2030. It has signed an engineering and construction services agreement with Aecon Group.

ARC Canada plans to build a 100MWe sodium-cooled fast reactor, the ARC-100, in New Brunswick before the end of the decade.

UK-based MoltexFLEX aims to build a 300MWe Stable Salt Reactor – Wasteburner (SSR-W 300) at Point Lepreau in New Brunswick by the early 2030s.

5) South Korea

In December 2022, the Korean government revealed plans to invest 400 billion won (US$300 million) in the development of a Korean SMR over the next eight years.

The Korea Atomic Energy Research Institute (Kaeri) has already received Standard Design Approval for a 100MWe system-integrated modular advanced reactor (SMART) back in 2012. It is now implementing the commercialisation of SMART with Saudi Arabia.

Kaeri and nuclear power plant operator Korea Hydro & Nuclear Power (KNHP) are also developing a basic design of a 179MW ‘innovative SMR’ (i-SMR). The South Korean government claimed that i-SMR could be pre-fabricated in a factory and completed within 24 months, as compared to 56 months for a large nuclear power plant built on site. The Suth Korean government aims to approve the i-SMR by 2028 and export it by the 2030s.

6) Argentina

Argentina’s National Atomic Energy Commission (CNEA) has restarted construction of the delayed 32MWe CAREM prototype SMR at the Atucha nuclear complex in Zárate. Completion is expected in 2025. If successful, a 100-200MWe commercial plant could follow.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM