What is the future for construction in Saudi Arabia?

25 July 2023

Saudi Arabia is currently building some of the world’s most audacious infrastructure projects as it seeks to decrease its reliance on the exportation of oil, reports Catrin Jones.

The Saudi Arabian construction industry, valued at US$120.4 billion in 2021, is poised for expansion with an anticipated annual average growth rate (AAGR) of 4% or more from 2023 to 2026, according to a report from Gulf Business.

This surge is driven by substantial investments in transportation, renewable energy, housing, and tourism projects, aligned with the Vision 2030 initiative – the country’s plan to reduce its dependence on oil, diversify its economy, and develop public service sectors. Construction plays a pivotal role in this strategy. With over 5,200 ongoing projects worth a combined total of US$819 billion, Saudi Arabia stands at the forefront of bustling mega-city construction.

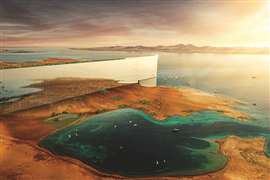

Groundbreaking US$500 billion linear city is said to redefine urban living (Photo: NEOM)

Groundbreaking US$500 billion linear city is said to redefine urban living (Photo: NEOM)

A smart city like no other

Saudi Arabia’s construction landscape is undergoing a dynamic transformation, driven by emerging trends and ambitious initiatives. One notable project is Th Line, a smart city initiative launched in 2020 near Riyadh by NEOM.

The groundbreaking US$500 billion linear city is said to redefine urban living and sustainability. Spanning a total of 170 kilometres, this futuristic development is said to have been designed to prioritise nature and human well-being, and has a commitment to renewable energy and advanced transportation systems.

It was announced earlier this year that a joint venture between Italian contractor Webuild and its Saudi Arabian counterpart Sajco had won a US$1.5 billion contract to build a high-speed rail line for the NEOM region.

The 57km high-speed connector railway will link The Line with Oxagon, NEOM’s industrial centre. The joint venture agreement for the railway line is split 70/30 between Webuild, through its local branch and its unit Salini Saudi Arabia, and Sajco.

The partnership includes civil works for the two high-speed and two freight railway tracks, with Webuild leading the execution of work. The contract also covers viaducts, road bridges, and road and rail underpasses to facilitate train speeds of up to 230 kilometres per hour.

NEOM also has other plans in Saudi Arabia, such as Oxagon. Resembling a giant hexagonal prism, the landmark will serve as a hub for innovation and technology, offering state-of-the-art research facilities, co-working spaces, and interactive exhibition areas.

The structure will be divided by a massive shipping canal and the floating sections of Oxagon will be interconnected by smaller canals, forming a water-filled network resembling Venice in Italy.

The project resembles a giant hexagonal prism (Photo: NEOM)

The project resembles a giant hexagonal prism (Photo: NEOM)

Urban planning is another crucial aspect gaining momentum in the Saudi Arabian construction market. By embracing concepts like green infrastructure and mixed-use developments, cities are becoming more resilient to environmental changes while enhancing liveability.

One of the projects driving green construction is the Red Sea Project, a large-scale luxury resort set to become a major tourist attraction in the Middle East. Spanning over 30,000 square kilometres, the project will feature a natural archipelago, desert landscapes, and archaeological treasures.

Upon completion, it will offer 8,000 new hotel rooms and become the region’s first fully integrated, luxury, mixed-use resort. Sustainability is said to be a key focus, with initiatives such as a zero-waste-to-landfill policy, carbon neutrality, and a ban on single-use plastics. It is scheduled for completion by 2030 and is expected to draw visitors from around the world.

Demand for skilled professionals in construction

According to Grace Najjar, Project Management Institute’s regional managing director for the Middle East and North Africa region, the construction industry will play a crucial role in achieving the goals of Vision 2030, providing immense job opportunities in the future.

She added that Saudi Arabia’s construction sector will see an increased demand for skilled professionals, such as project managers, engineers and architects.

“Over 5,200 projects across Saudi Arabia, with a combined worth of US$819 billion, are currently underway, representing 35% of all active GCC (Gulf Cooperation Council) project values.

“With such a vast number of projects, there will be a significant demand for skilled professionals in the construction industry, including project managers, engineers, architects and skilled labour,” said Najjar.

The Saudi Vision 2030 has pushed a number of giga projects into fruition. MEED, formerly Middle East Economic Digest, estimates that there are US$879 billion of projects planned with only US$50 billion of those having been awarded so far.

According to a report by the US-Saudi Business Council, the Saudi Arabian construction sector experienced significant growth last year, with the value of awarded contracts returning to pre-pandemic levels.

The report reveals that the total value of awarded contracts in 2022 was SAR 192.4 billion (US$51.3 billion). The real estate sector is said to have accounted for the largest share of construction spending with NEOM receiving the highest level of investment.

There was a 35% increase in the value of awarded contracts last year compared to the previous year. The report also shows that, during the final three months of last year, the value of awarded contracts in Saudi Arabia skyrocketed to SR71.5 billion (US$19.1 billion), representing 37% of the total awards for the year.

This surge marked the highest value of awarded contracts in a quarter in nearly seven years, since the first quarter of 2015.

Back in February, Saudi Arabia’s sovereign wealth fund invested a total of US$1.3 billion in four local construction firms to support the sector that is spearheading projects.

According to Alarabiya News, the Public Investment Fund said it had acquired new shares as part of capital increases representing significant minority stakes in: Nesma & Partners Contracting Company, ElSeif Engineering Contracting Company, AlBawani Holding Company and Almabani General Contractors Company.

The role of robotics and AI in Saudi Arabian construction

Projects in the country come to a combined total of US$819 billion (Photo: AdobeStock)

Projects in the country come to a combined total of US$819 billion (Photo: AdobeStock)

Contractors in the country are increasingly adopting automated solutions. Robotic bricklayers and AI-assisted drones are becoming common, reducing costs, saving time, and ensuring adherence to safety standards.

The use of robotic construction in the Middle East has become increasing popular, propelled by increased investments.

The Saudi National Industrial Strategy, unveiled as part of the Vision 2030, further emphasises the objective of attaining global leadership in high-tech manufacturing and development. This encompasses various technologies such as AI, robotics, 3D printing, and more, which hold the potential to revolutionize not only the construction sector but also other segments of the Saudi economy.

According to a report by PricewaterhouseCoopers, the integration of robotics and AI could contribute over US$135 billion to the Kingdom’s economy by 2030.

Other trends in construction include the adoption of prefabrication technology as an efficient and cost-effective alternative to traditional onsite building methods. The trend is particularly prominent in the residential sector and this demand has led Swedish modular home manufacturer SIBS to secure a deal to deliver 2,174 apartments to NEOM.

SIBS has signed an engineered equipment supply contract to manufacture the apartments, to be distributed among 35 buildings in Saudi Arabia’s special economic zone in the northwest of the country. The project is scheduled to be delivered by the third quarter of 2024. The buildings will be fitted with solar panels and are designed for future relocation if needed.

Saudi Arabia is shaping its future through the construction industry and transformative projects like NEOM as it looks to diversify its economic landscape. Ventures such as this are playing a key role in catapulting it onto the global stage, and there looks to be no let-up in the pipeline of ambitious construction projects.

Saudi Arabia has unveiled its plans to construct a large cubic edifice in Riyadh, boasting sides that span a total of 400 metres in length and a floor area of 2 square kilometres.

The project, named the Mukaab, is the brainchild of the New Murabba Development Company, led by Saudi Crown Prince Mohammed bin Salman and owned by the nation’s Public Investment Fund.

The building’s outer structure will serve as a protective shell, encompassing a dome, which will enclose a helter-skelter-like tower.

The architectural style chosen for the Mukaab will be a modernized rendition of Najdi architecture, providing a contemporary twist to the traditional appearance of Arabian domestic buildings.

Foreign workers drive sector

By the end of the fourth quarter of 2022, the construction sector in Saudi Arabia employed approximately 2.46 million workers who were covered by social insurance regulations.

According to Saudi business newspaper Al-Eqtesadiah, foreign workers accounted for the largest proportion in the sector, comprising around 85.4%, roughly 2.1 million workers. Saudis constituted 14.6% of the workforce in the construction sector, amounting to 369,600 employees. The number of female employees in the sector reached 152,500, with Saudi women representing the highest percentage. The country has received condemnation for its treatment of women and their lack of rights and legal protection.

In terms of the cities with the highest concentration of workers in the construction sector, Riyadh, the capital, had the highest proportion, accounting for 39.6% with 972,600 employees.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM