Read this article in Français Deutsch Italiano Português Español

What construction inflation in Europe looks like for 2025

27 November 2024

Image created using artificial intelligence

Image created using artificial intelligence

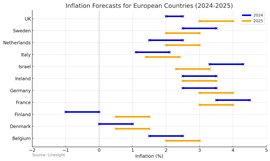

Inflation has been an economic thorn in the side of countries all over the world in recent years but recently, cost pressures have started to reduce.

Nonetheless, inflationary pressures in Europe could remain a challenge in 2025 as the construction industry prepares for a revival in its fortunes.

That’s according to a new set of region-wide inflation forecasts issued by consultancy Linesight.

Europe’s construction sector has endured a difficult 2024 amid faltering consumer and business confidence, elevated interest rates and high labour costs.

The struggling residential sector was once again Europe’s weak point, with the situation particularly poor in Europe’s biggest economy, Germany. There has also been a slowdown in construction for the battery and semiconductor sectors amid changing demand.

But the decline in residential has been offset to some extent by growth in infrastructure, industrial energy and data centre projects, Linesight said.

Revival for European construction in 2025?

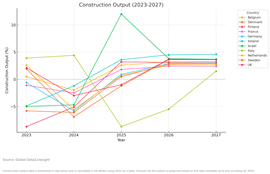

It forecast positive growth for most European countries in overall construction output in 2025 (see above), driven by industrial, infrastructure, energy and utilities projects spurred by public investment. The data centre market is also set to continue to provide a consistent source of new work for construction companies.

Although Linesight’s report acknowledged the victory of Donald Trump in the US presidential election and the collapse of Germany’s government, many of its forecasts were compiled in the run-up to those events.

Linesight acknowledged that nothing is certain when it comes to forecasts but told Construction Briefing it nonetheless remains confident in its assertion that construction output in Europe will grow in 2025.

It pointed to funding from the European Union (EU) in the form of the Recovery and Resilience Facility (RRF), the centrepiece of Next Generation EU, as being a key source of support, with a maximum of €807 billion being spent on reforms and projects, in addition to national-level spending programmes.

The continued growth in demand for artificial intelligence (AI), meanwhile, means that the size and scale of sectors like data centres and semiconductors should grow significantly, it said.

While the residential sector is not a key one for Linesight, it told Construction Briefing that decreasing interest rates suggested some countries currently experiencing slowdowns can expect to see improvements there too, although likely only from 2026 onwards.

Construction prices set to increase in 2025

The improved picture means that prices could rise as demand for already-scarce labour increases and contractor availability dwindles, Linesight said.

Fortunately, prices for energy-intensive commodities are “stable” according to its report but may rise in some countries due to carbon levies aimed at promoting decarbonisation.

It added that volatility in metal prices remains a concern, with metals such as copper and aluminium elevated as compared to 2023 levels, while stainless steel is volatile due to supply, raw material volatility and import costs.

It warned that conflicts in the Middle East could impact material costs and delivery timelines, which could also drive cost inflation.

Diesel prices fell across Europe in the past year, and Linesight predicted that this trend would continue into 2025, aside from a short spike driven by the recent rise in crude oil prices.

And when it comes to longer-lead items it highlighted how cooling solutions are a “critical trend to monitor”, especially for data centre operators. The red-hot demand for data centres means that supplier capacity and lead times have started to be impacted.

“Addressing the demand for AI computing and the densification of data centres will continue to pose significant challenges in 2025. The increased need for power and cooling solutions will further pressurise the supply chain capacity,” it noted.

Richard Joyce, managing director of Linesight Europe, said, “Improving GDP outcomes projected across Europe and the UK, along with easing inflation are likely to boost construction activity across the region in 2025. This is a positive sign for the year ahead, but challenges persist in the form of labour shortages, contractor availability and insolvency rates. The exponential rise of AI and the growing focus on alternative energy is likely to keep fuelling growth in the data centre and energy markets, making it imperative to bolster supply chains in these sectors.”

To read a full copy of the report, click here.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM