Stable engineering in Europe

16 May 2019

Strong engineering markets have been highlighted in the latest sector review from the European Federation of Engineering Consultancy Associations (EFCA), as well as continuing challenges.

Henrik Garver, CEO of the Danish Association of Consulting Engineers and Chair of EFCA’s Barometer task group, said that, in general, markets for consulting engineering services in Europe have increased in strength.

He tempered this, however, by pointing out that southern countries continue to face difficult market conditions, whereas northern countries tend to have trouble generating profit.

Increasing turnovers as well as rising order stocks add to the view that European markets that have increased in strength.

Furthermore, development is not consistent across all 21 responding countries as Greece, Turkey and Spain appear to struggle with difficult market conditions.

Profitability appears to have improved or remained the same across all countries except for Denmark and Norway, which declared a reduction in profitability during 2018, compared with 2017. Profitability is expected to increase or to stabilize for 2019 compared with 2018, except for Turkey and Norway.

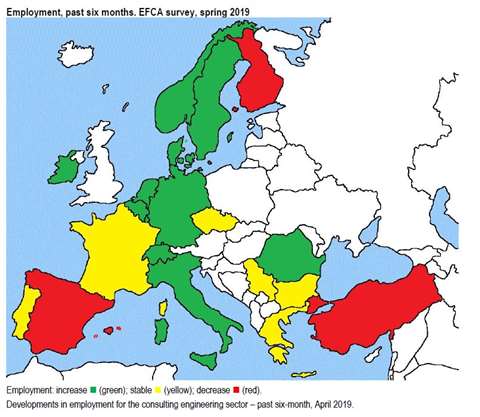

The growth in revenue, and thus growing demand for consulting engineering services is only partially accompanied by an increase in staff. Despite an overall upward trend, only half of the countries, which have experienced or are expecting rising markets have proportionally adapted their staff.

The findings indicate that while markets are generally strong, the industry continues to face several challenges. Low fees indicate either a strong competition or a trend toward standardisation of services while continuous staff shortage tends to increase salary costs. Digital transformation may be a key issue in reducing production costs, handling staff shortage and increasing productivity and profitability.

Garver said, “Another trend that we will follow closely in the future is competition from contractors. Competition from contractors has increased at a fast pace over the last couple of years, and this will, if it continues, change the dynamics in the market.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM