Construction equipment sales up on pre-Covid levels

17 January 2022

The CEA’s Market Analyst, Paul Lyons, provides his insight into what is happening in and around the construction equipment market.

Paul Lyons, CEA Market Analyst

Paul Lyons, CEA Market Analyst

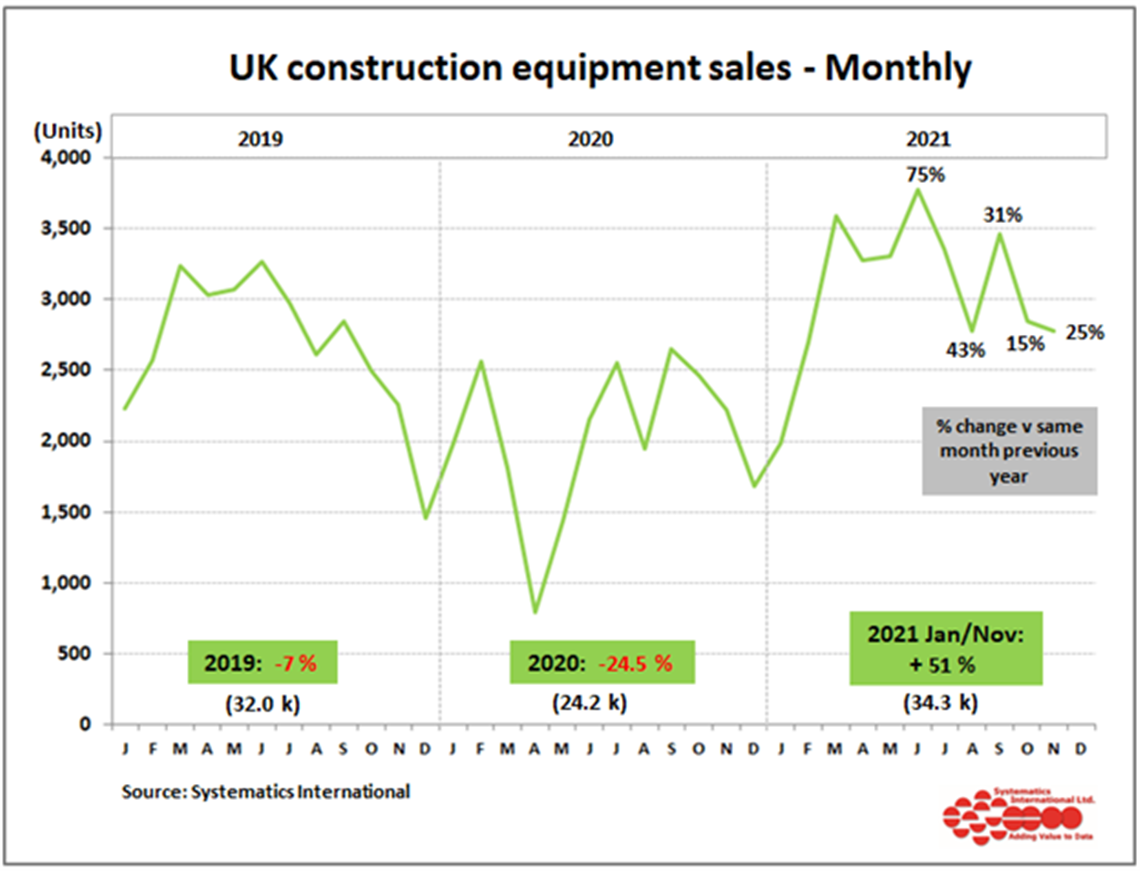

Retail sales of construction and earthmoving equipment were 25% higher than 2020 levels in November 2021. As a result, sales in the first eleven months of last year were 51% up on 2020 levels, reaching over 34,000 units, as shown in the graph below.

As expected, the rates of growth in sales in recent months compared with 2020 are moderating to lower levels when recovery of sales was strengthening in the closing months of 2020.

However, the latest updates are still demonstrating strong market demand, as reported by many CEA members, despite the impact of supply chain issues for materials and labour constraining construction market activity.

Taking on board the latest update on equipment sales, it looks likely that equipment sales in 2021 will end the year at something like 45% to 50% up on 2020 levels, and be ahead of sales in both 2018 and 2019.

Looking ahead, in their latest forecast for the UK market, Off-Highway Research are anticipating that sales will be relatively flat in 2022, showing only 1% growth.

This reflects the fact that sales have reached a peak level in 2021 and are unlikely to show further significant growth, particularly when supply chain difficulties are likely to remain for at least the first half of 2022.

Construction equipment sales by machine type

A distinctive feature of equipment sales in 2021 has been the major switch around in growth rates for some of the most popular equipment types.

Mini/midi excavators (under 10 tonnes) are the most popular equipment type in the UK market and were the strongest growing product in 2020.

However, in 2021, they have shown the weakest growth with sales at only 36% ahead of the previous year’s levels in the first eleven months.

In contrast, sales of Telehandlers (for the construction industry) which were the weakest growing product in 2020, have been the strongest in 2021, with sales more than double 2020 levels, on a year to date basis.

Construction equipment sales in the Republic of Ireland are also recorded in the statistics scheme run by Systematics International.

The latest update showed that sales in November 2021 stayed above the previous year’s levels, recording a 9% increase compared with the same month in 2020.

This takes year-to-date sales in the first eleven months of 2021 to 22% above the previous year’s levels in the Republic of Ireland.

Growth in construction activity slowed in 2021

The latest figures from the Office for National Statistics (ONS) show that construction output in the first ten months of 2021 to October was 15% above the same period in 2020.

However, this includes comparisons with Q2 and Q3 2020, when output suffered from the impact of lockdown. In the third quarter of 2021, output declined by 1.5% compared with Q2, and represents the first quarterly decline since Covid hit in early 2020.

This is blamed on the difficulties in sourcing materials and labour holding back activity on construction sites, while underlying demand for new construction work remains strong.

The Construction Products Association (CPA) published their Autumn forecast for the UK construction market in October.

This anticipates an increase in construction output of just over 14% for 2021, which matches the level of decline in output in 2020.

Construction output forecast 2022

The latest forecast for 2022 is for just under 5% growth in output. This positive outlook comes despite the dual constraints of continued shortages and sharp cost rises for both construction products and skilled labour over the next 12 months.

The CPA’s latest forecast shows the infrastructure sector to be the key driver of construction growth for 2022.

Less affected by supply-side issues than other areas of construction, the main activity in the sector is due to work on five-year spending plans within the regulated sectors of rail, water, roads and energy.

Growth above general activity levels will be driven by major projects such as the Thames Tideway Tunnel, Hinkley Point C and HS2.

Infrastructure output is forecast to rise by nearly 24% in 2021 and by just under 10% in 2022, as the sector reaches record levels due to main works on HS2. https://www.constructionproducts.org.uk/

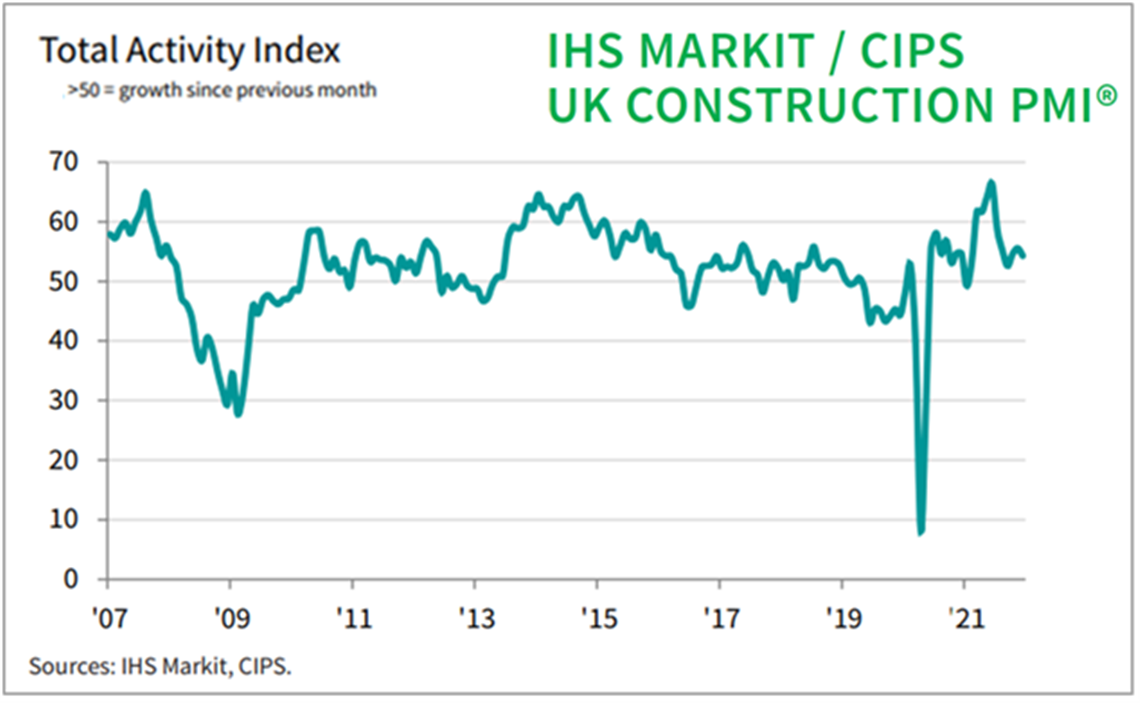

Likewise, the UK construction Purchasing Managers Index (PMI) published by IHS Markit is also a good indicator of sentiment within the UK construction industry.

The latest update for December shown in the chart below suggests that activity was relatively stable in Q4 with the index recording between 54 and 55 each month, indicating modest growth.

An encouraging feature in the December survey was the number of companies reporting supplier delays is continuing to decline, falling to 34% after being at 47% in November.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM