Wheeled loader market returns to health

12 September 2018

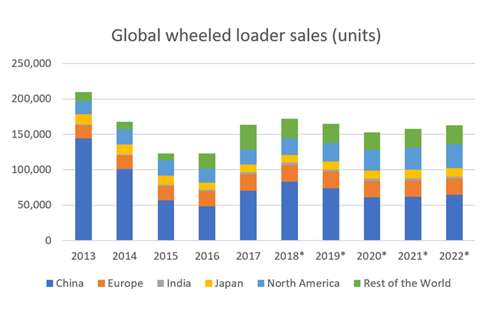

Global sales of wheeled loaders in 2018 are expected to reach more than 170,000 units for the first time in five years, according to a new report from specialist consultant and market forecaster Off-Highway Research.

Demand last year reached 163,139 units, a 33% rise on 2016, and these machines had a retail value of US$14.8 billion (€12.73 billion).

Off-Highway Research said the key driver of this growth was a surge in the Chinese market, which represented 43% of global sales in 2017. The underlying factor here was said to be a sharp increase in infrastructure investment by the Chinese Government, and through the Public Private Partnership (PPP) model.

However, wheeled loaders were seen to be declining in relative popularity in China as a result of a rise of compact and crawler excavators, and “economical” wheeled loaders as alternative tools.

This year is expected to represent the high point in terms of unit sales, with global demand stabilising between 150,000 and 165,000 units over the next five years. However, the value of the segment is set to continue rising, said Off-Highway Research.

Managing director Chris Sleight said, “The expected decline in wheeled loader sales in China over the next two to three years will see overall global sales decline. However, this will be partially offset by growth elsewhere in the world, most notably in North America.

“The decline of a relatively low-cost market in China and the rise of a higher one in North America, means the value of the global wheeled loader segment will continue to climb despite the dip in unit sales. The value of the sector is expected to reach US$17.8 billion (€15.31 billion), in today’s prices, by 2022, compared to US$14.8 billion in 2017.”

According to Off-Highway Research, the global population of wheeled loaders has risen by some 75% over the last decade from 1.3 million machines in 2008 to 2.23 million this year. Again, this was said to be almost entirely a result of the influence of China, which is believed to be home to 60% of the world’s active fleet.

Construction contractors are the largest customer group for wheeled loaders, followed by the extraction industries – predominantly mining and quarrying.

However, Off-Highway Research said these two traditional industries only accounted for 58% of demand last year.

Other significant customer groups include various public sector entities, equipment rental companies and agriculture and forestry.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM