What does 2023 hold for the German construction market?

20 April 2023

The post-pandemic economic recovery that started in the spring of 2022 was cut short by the energy and cost-of-living crises caused by the Russia-Ukraine war, but November–December data releases suggest the current recession could be shallower than had been previously feared.

How will Germany’s construction market fare against the backdrop of a challenging economy? Photo: Oxford Economics

How will Germany’s construction market fare against the backdrop of a challenging economy? Photo: Oxford Economics

The fallout from the Russia-Ukraine war only began to seriously dampen Germany’s economic activity when gas and power prices skyrocketed, owing to Russia’s progressive curtailment of gas exports.

During the fourth quarter, however, gas storage temporarily reached 100% of capacity, and it became clear that construction of three floating liquefied natural gas (LNG) terminals would be completed around the turn of 2022/23.

This greatly reduced concerns about possible gas rationing in German industry during the winter, enabling business sentiment to rebound during November–December.

Nevertheless, higher energy security has come at a cost, and gas and electricity prices will likely never return to pre-2021 levels.

Interest rates

The additional boost to inflation has forced the European Central Bank (ECB) into aggressive monetary tightening while damaging consumers’ real purchasing power and firms’ profitability.

This will likely ensure that the German economy undergoes a recession during the two quarters saddling the turn of 2022/23, even if this now appears to be shallower than feared initially.

Price of security

Fixed investment, which had suffered less from the pandemic than expected, declined in the second quarter of 2022, driven exclusively by construction. In contrast, investment in equipment expanded throughout 2022, defying the restraining influence from war-related uncertainty and the ECB’s monetary tightening.

The pandemic and Russia-Ukraine war are causing major shifts in Germany’s economic structure and global supply chains, with more future emphasis being put on security than on minimising costs.

These adjustments should do some harm to potential GDP growth given deglobalisation tendencies that weigh on productivity.

The downturn in German construction extended into the final month of 2022, with housing activity exhibiting a particularly sharp rate of decline in the face of high prices, rising interest rates and heightened economic uncertainty.

The latest PMI data from S&P Global shows building companies remain in retrenchment mode, scaling back their purchasing activity as well as streamlining employment.

Confidence stalled

The headline S&P Global Germany Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered 41.7 in December. This was little changed from November’s 41.5 and still firmly below the 50.0 threshold that separates growth from contraction.

Of the three construction categories monitored by the survey, housing activity remained the weakest by far, recording the steepest rate of decline since February 2012.

Commercial activity posted the sharpest fall since last September, whereas as the decline in civil engineering activity eased noticeably on the month.

Lower activity across Germany’s construction sector reflected a multitude of headwinds to demand – including spiralling prices, tightening financial conditions and general investment reluctance – and an associated reduction in inflows of new work.

December marked the tenth month in a row in which a decrease in new orders has been recorded. The rate of decline remained sharp but eased for the second time in the past three months.

Building companies reacted to falling workloads by paring back their purchasing activity during December for the ninth month in a row.

New opportunities

The rate of decline was quicker than the average over this sequence despite easing from the previous survey period.

There was a further reduction in construction sector employment at the end of the fourth quarter, and the pace of job shedding quickened to the fastest since last September. The non-replacement of leavers was cited by a number of surveyed firms.

The use of subcontractors likewise decreased during December, in line with the trend observed in each month since last April. This contributed to the first improvement in subcontractor availability in over two years.

More positively, the sustained reduction in demand for building materials and products further alleviated the pressure on construction supply chains.

However, December’s survey showed that German constructors remained deeply pessimistic about the outlook for activity over the next 12 months.

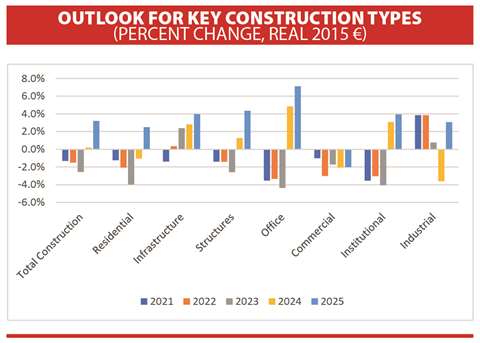

Office construction offers little to no improvement until 2024, by which time companies can have assessed actual space needs in the changed office environment. With some permanent reduction to in-office time, current spending is on renovation to rationalize the current office stock with projected in-office hours.

The greatest challenge is to the commercial sector. While the hospitality industry offers potential as it recovers from its deep pandemic slump, the large retail sector will be a hindrance to growth as e-commerce consumes an ever-larger share of spending and conventional store growth falls.

While warehousing and logistics will see strong growth, the value of these structures is lower than that of retail with a net negative effect.

Infrastructure was least impacted by the pandemic, and even benefited from re-purposing of Covid-support spending in 2022, particularly into energy and transportation projects.

Incremental growth

Germany has made developing infrastructure a priority, although it now remains to be seen whether the need for additional defence spending requires some re-assessment and re-allocation of investment plans.

We expect to see continued incremental growth improvement through to at least early 2025.

Manufacturing construction has held up relatively well this decade, however, there are indications of slowing as the German economy transforms its energy usage, reshoring limits exports to some countries and a slowing global economy reduces demand to others.

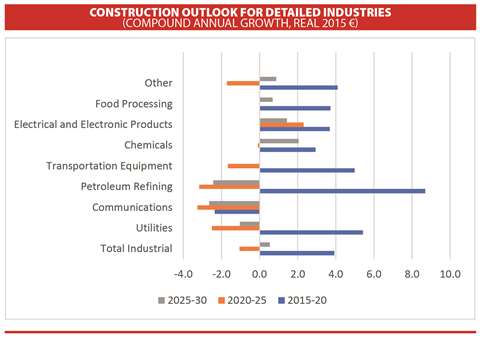

To better see the evolution of priorities, construction spending is grouped in five-year increments above.

About the author Scott Hazelton is a director with the Global Construction team at the market analyst IHS Markit. Scott has over 30 years’ experience in construction, heavy equipment, building materials and industrial manufacturing markets. |

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM