Read this article in Français Deutsch Italiano Português Español

US construction costs climb as trade groups note Trump’s tariff impact

13 June 2025

Construction input prices in the US rose again in May, with costs accelerating across a range of materials and services even before the latest round of President Donald Trump’s steel and aluminium tariffs took effect on 4 June.

Creative image illustrating rising construction material prices in the US. (Image generated by AI)

Creative image illustrating rising construction material prices in the US. (Image generated by AI)

Industry groups say the figures reflect growing inflationary pressure on contractors, driven by both market volatility and trade policy uncertainty.

According to new data from the US Bureau of Labor Statistics, the producer price index (PPI) for materials and services used in non-residential construction increased 0.4% in May and 2.2% year-over-year, which is the largest annual jump since February 2023.

A closer look at construction material costs on the rise

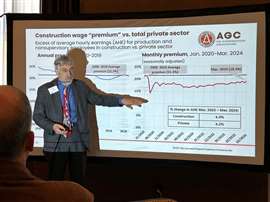

Associated General Contractors of America (AGC) Chief Economist Ken Simonson presents to the AGC Greater Milwaukee chapter in Wisconsin in 2024. (Image: Mitchell Keller)

Associated General Contractors of America (AGC) Chief Economist Ken Simonson presents to the AGC Greater Milwaukee chapter in Wisconsin in 2024. (Image: Mitchell Keller)

Industry trade association Associated General Contractors of America (AGC), which analysed the data, said the increase was driven largely by steel pricing but noted upward pressure across other categories, including concrete products, insulation, and subcontractor services.

Aluminium mill product prices rose 8.8% year-over-year, despite a 3.6% decline in May. Steel was the largest single contributor to May’s increase, with mill product prices up more than 7% month-over-month.

AGC’s chief economist, Ken Simonson, called the trend “alarming’. He noted the price hikes came before the impact of June’s tariff hike – which raised duties on certain steel and aluminium imports from 25% to 50% – and broader inflation was already gaining momentum.

“The acceleration in the year-over-year rate of increase is alarming, given that most of the tariffs announced so far were not in effect when these prices were collected on May 11,” Simonson said. “It is likely that contractors will be hit with substantial additional price increases shortly, unless the tariffs are postponed or rolled back.”

Separate analysis from another trade association, the Associated Builders and Contractors (ABC), highlighted similar concerns.

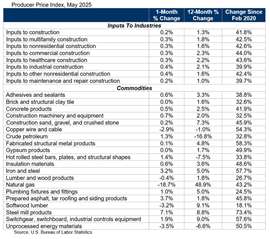

ABC said overall construction input prices rose 0.2% in May, with non-residential inputs up 0.3%. While year-on-year price growth appeared modest (1.3% for all construction inputs), the group warned that this figure obscures a steeper climb in 2025 alone.

“Costs have increased rapidly since the start of this year, with input prices rising at a 6% annualised rate through the first five months of 2025,” said Anirban Basu, ABC’s chief economist. “Accelerating input price escalation is largely due to rapid price increases for tariff-affected goods like iron and steel. Expect this dynamic to remain over the next few quarters.”

And May’s increases were not limited to metals. According to the BLS data compiled by AGC, insulation materials rose 0.6% in May and 3.6% year-over-year. Precast concrete prices increased 0.8% for the month, while subcontractor services also ticked upward; including a 0.7% rise for plumbing contractors and 0.4% for office building construction.

US contractors remain optimistic despite price increases

(Table courtesy Associated Builders and Contractors)

(Table courtesy Associated Builders and Contractors)

Despite the largely negative data, ABC’s Construction Confidence Index shows that contractors remain optimistic about their profit margins.

Basu noted that softer-than-expected national inflation figures for May raised expectations for Federal Fund interest rate cuts later this year. Reduced rates would ease borrowing costs for banks and financial institutions and, in theory, lower rates support construction project financing.

AGC, however, offered no such note of relief.

The association focused squarely on trade-related pressures and the likelihood of further price shocks. AGC also noted domestic producers have already responded to the 4 June tariff hike with price increases, raising concerns about a broader inflation ripple across supply chains.

“Construction firms are in no position to absorb or push back against tariff-driven cost increases,” said AGC CEO Jeffrey Shoaf. “The Trump administration should abandon plans to impose tariffs on materials that will drive up the cost of construction projects.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM