House building slump sparks UK construction’s fastest slide since 2020

06 October 2023

Image: Richard Johnson via AdobeStock - stock.adobe.com

Image: Richard Johnson via AdobeStock - stock.adobe.com

A sharp downturn in house building activity has led to the fastest slide in construction activity since May 2020, according to a new survey of construction buyers.

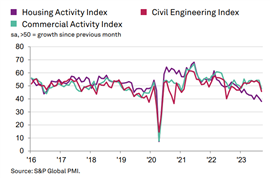

The September S&P/CIPS UK construction purchasing managers’ index (PMI) found that total UK construction industry activity decreased for the first time in three months and at the fastest pace in more than three years.

All three main segments of the industry posted a reduction in business activity, led by a steep fall in house building.

Falling workloads also led to the fastest rise in subcontractor availability since June 2009.

The headline PMI registered 45.0 in September (where 50.0 indicates no change in activity), down from 50.8 in August. It was the first time the index has fallen below 50.0 since June.

Residential work (38.1) was the worst-performing area of construction output in September, followed by civil engineering (45.7). Outside of the pandemic, the latest fall in housing activity was the steepest since April 2009. Survey respondents blamed rising borrowing costs and weak demand conditions as the reasons for cutbacks to housing projects.

Commercial building declined at a more modest pace (47.7), with some companies concerned that client demand had dampened.

Total new business received by construction companies fell for the third time in the past four months during September and the rate of decline was the steepest seen since May 2020.

The overall rate of employment growth was also the weakest since June, as construction firms slowed their rate of job creation amid lower demand from clients.

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), said, “The impact of high mortgage rates and low house buying demand continues to flow through the supply chain and negatively hit the UK construction industry. It has been a tough year for residential construction and the sharp decline in September shows the pressure on the sector is still a long way from easing, despite the pause on the raising of interest rates.

“After some positive signs over the summer months, September saw a bump back down to earth for commercial construction as concerns over the future of the economy hampered demand and delayed new projects.

“There is some comfort in the fact that the days of disrupted supply chains and soaring inflation are behind us for the time being, with delivery times continuing to fall and input prices remaining stable. The lack of activity has given space for suppliers to catch up with demand and create slack in the supply chain, which the construction sector will be hoping to take advantage of once demand returns.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM