Economic outlook: will Australian construction see growth in 2022?

15 June 2022

Construction will see solid growth, but with a new government elected more policy details are needed to see what their plans mean for the industry, says Scott Hazelton from IHS Markit.

Australia will see above-trend real Gross Domestic Product (GDP) growth at 3.5% in 2022 on the strength of commodity prices. Economic growth in 2022 will be supported by a return to some sort of normalcy from Covid thanks to high vaccination rates, as well as the broader reopening of international borders to vaccinated visitors in late February 2022.

Australia will see above-trend real Gross Domestic Product (GDP) growth at 3.5% in 2022. (Photo: Adobe Stock)

Australia will see above-trend real Gross Domestic Product (GDP) growth at 3.5% in 2022. (Photo: Adobe Stock)

Significant demand for Australian commodities exports such as coal, liquefied natural gas, iron ore, and cereal crops in the wake of the Russian-Ukrainian war will also be supportive of growth and real export growth (goods and services) of 8% in 2022.

The pipeline of dwelling approvals from the government’s HomeBuilder program, stronger-than-expected non-dwelling construction activity, and robust equipment spending bolstered fixed investment growth in 2021.

The pipeline of residential work is at risk of stalling from skilled labour shortages and high input costs. Additionally, the pace of machinery and equipment spending in 2021 is unsustainable in 2022, resulting in real fixed investment growth slowing from 9.2% in 2021 to 2.1% in 2022.

Consumer confidence has slipped with surging prices and the potential for accelerated monetary policy tightening. Built-up savings provide a buffer for consumer spending in the near term with private consumption increasing 3.7% in 2022.

Yet, disposable income erosion from high inflation, combined with high household debt levels, plateauing home prices in major cities, and the threat of rising interest rates will encourage spending restraint resulting in real private consumption growth of just 3.2% for 2023 and slower growth for residential construction.

The Reserve Bank of Australia (RBA) raised its policy interest rate by 25 basis points to 0.35% in May. IHS Markit expects a front-loaded approach to monetary policy tightening in response to inflationary pressures with the policy rate reaching 1.25% by September 2022.

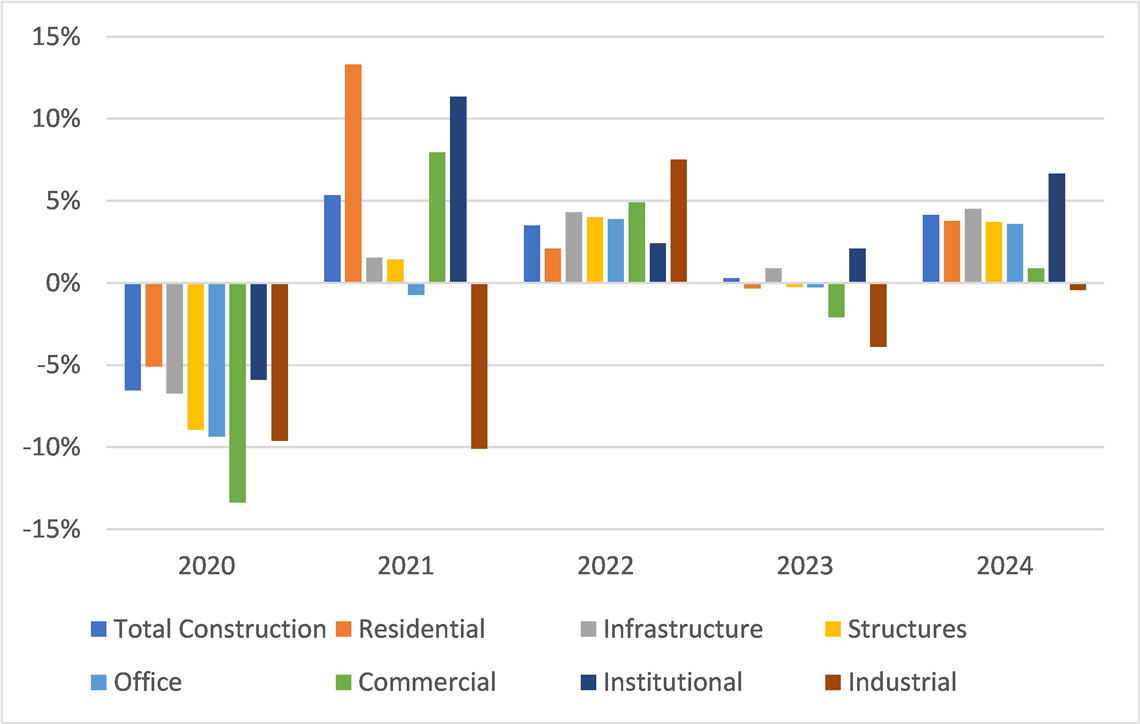

Outlook for Key Construction Types (Percent change, Real 2015 US$)

Outlook for Key Construction Types (Percent change, Real 2015 US$)

The bank will then space out further rate hikes as it gauges overall inflation and economic conditions. Also pressuring the RBA to move sooner on policy tightening is the upside surprise in inflationary pressures stemming from the Russia-Ukraine war, price adjustments from government agencies/policies, and mounting domestic price pressures.

This, combined with low unemployment, will likely result in Australian inflation holding above the RBA’s target through the end of 2022, and annual average inflation of 4.4% for 2022.

What plans do Australia’s new government have for construction?

The latest development for the country is the election of a Labor government. We expect the new government to maintain much of the proposed budget, although details were scarce in the campaign. The largest potential for altered priorities is with energy infrastructure.

Labor campaigned on cutting 2030 carbon emissions by 43% from 2005 levels, while boosting spending on renewable energy and driving demand for electric vehicles via tax incentives and development of community-owned solar power and battery projects.

The combined effort would expand renewable generation to 26GW by 2030 and push electric vehicle sales to nearly 90% of new car sales by 2030. Accomplishing this will require a US$14.2 billion investment to upgrade the electric utility grid to handle new renewable capacity, as well as US$140 million for community battery projects and US$70 million for ‘solar banks’.

Separately, allowable emissions from large mining and energy companies are likely to be tightened, creating additional construction potential via renovations to facilities.

Residential construction is particularly sensitive to interest rates, material prices and consumer confidence and could contract modestly next year. Office construction also looks to be weak in 2023 as companies assess space needs in the wake of the pandemic.

The greatest challenge is to the commercial sector. While the hospitality industry offers potential as it recovers from its deep pandemic slump, the large retail sector will be a hindrance to growth as e-commerce consumes an ever-larger share of spending and conventional store growth falls. Institutional structures fare the best in 2023, although at reduced growth rates.

Infrastructure also sees growth in 2023, but at reduced levels. There is some potential for a stronger outlook as Labor introduces its energy program. Even so, it will take time for new initiatives to turn into actual groundbreaking.

Australia’s construction manufacturing sector represents about 20% of non-residential structural spending. It also offers some of the greatest shifts in priorities over the medium to long term.

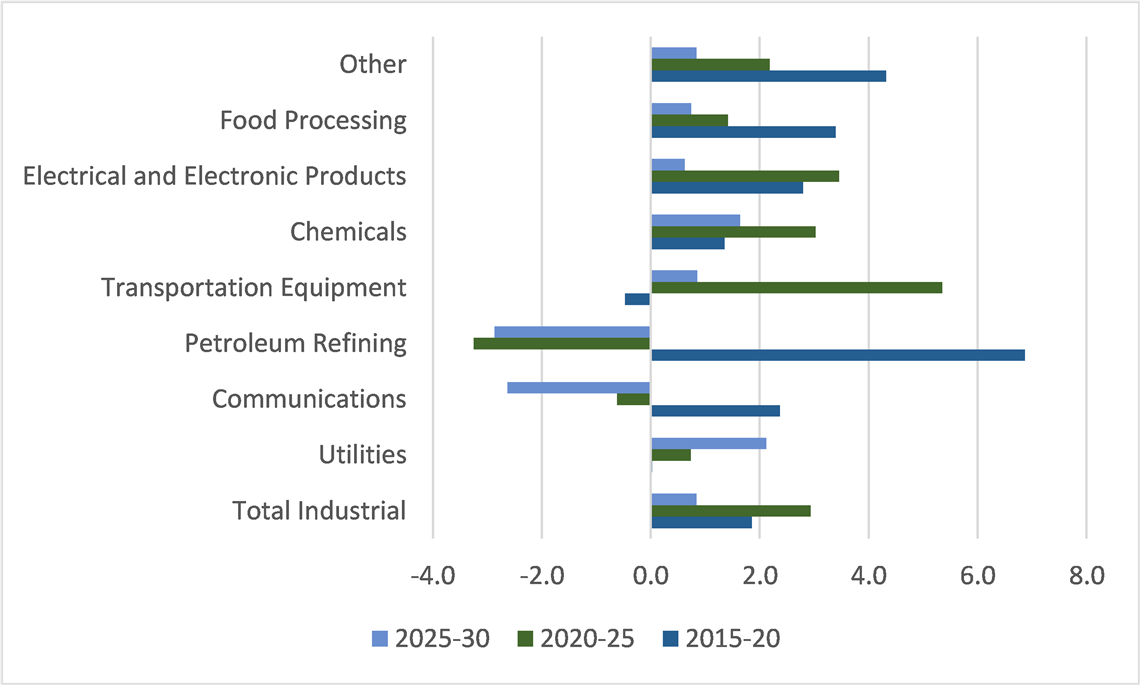

Construction Outlook for Detailed Industries (Compound annual growth, Real 2015 US$).

Construction Outlook for Detailed Industries (Compound annual growth, Real 2015 US$).

Overall, manufacturing will become less important to the construction economy as the rate of growth recedes over the next decade, falling to only about 12% of non-residential structures. Utilities will be a long-term winner as Australia works toward a net zero economy.

As energy independence is achieved, and as the rest of the world also moves away from hydrocarbons, refining becomes less important with consequently reduced investment. Some petroleum-based activity will remain to support the chemical industry, which will see growth.

Transportation equipment investment has a very strong near term, but may tail off as plants complete transition to EVs with fewer parts.

Communications sees a dramatic change to its outlook over time. This is partly a function of massive investments made into telecommuting during Covid lockdowns, but it also reflects the expansion of broadband services in general.

The outlook for construction is generally positive, although volatility is likely over the next couple of years. Australia’s non-residential structural spending is tied not just to domestic demand, but global output. Total real construction spending is expected to continue its post-Covid rebound, growing 3.5% in 2022.

However, tighter monetary and fiscal policy, combined with uncertainty in key export markets suggest that 2023 could see minimal growth, projected at just 0.3%. If the myriad issues impacting the global economy see resolution over 2023, solid growth at 4.2% can be expected in 2024.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM