CECE: ‘Challenges persist despite economic optimism’

22 July 2021

With the European construction equipment industry booming, a more flexible approach to a volatile market is required

Sales of construction equipment in Europe grew by 11 per cent in the first quarter of 2021 compared with Q1 2020. The industry has been experiencing, as a result of Covid-19, market fluctuations and changes not seen before.

Following lockdowns across Europe in 2020, resulting in temporary lay-offs and halts in production, the sector experienced extraordinary boosts in demand in Q4 2020 and Q1 2021. This created new bottlenecks on the supply side of the industry, and production capacity shortages.

Riccardo Viaggi, CECE’s secretary-general

Riccardo Viaggi, CECE’s secretary-general

This provided significant challenges for equipment manufacturers to develop the flexibility required in their production processes to address these issues.

The relatively modest growth of 11% in the first quarter of this year does not fully reflect the market volatility. Growth rates were moderate mainly because the two largest markets of Germany and France, which account for almost 40% of total European demand, saw flat sales.

With the exception of Spain, all other European markets saw significant growth in demand in the first quarter, with many seeing growth above 20%. In addition, longer machine delivery times may have prevented sales from fully meeting market demand in Q1 2021, another reason for modest growth levels.

Looking at long-term comparisons, Q1 2021 sales in Europe reached the highest level since 2008. A notable feature was that individual construction equipment sub-sectors showed similar levels of recovery after the first wave of the pandemic. Tower cranes were the only exception, experiencing above average growth rates.

Coping with market volatility

The European construction equipment sector experienced a surprisingly quick recovery following the start of the Covid-19 crisis. The strong pick-up in demand in the first quarter of the year suggests that the pre-crisis levels of 2019 could be reached again in 2021.

A key question is whether potential market demand levels can be met, given the significant supply-side bottlenecks that are emerging.

Levels of machines stocks have declined significantly, and delivery times have increased, due to capacity limits and shortages of components. Container transport from Asia has also become a bottleneck, influencing both availability of components and machines.

Another issue troubling manufacturers is the persistently high price of steel. But the biggest challenge right now is to manage the volatility of the market. The industry needs more ways to react quickly, including flexible working time models and temporary employment options.

Encouraging outlook for European manufacturers

However, against this background, European manufacturers continue to be extremely optimistic about market prospects within the coming months.

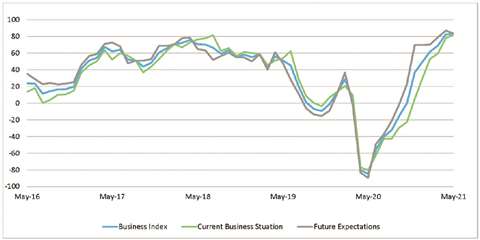

CECE’s Business Climate Index, measured in the monthly Business Barometer survey, hit rock bottom in May 2020. It then showed continuous improvement month-on-month to reach the highest values ever recorded, in April and May 2021.

Both order intake and sales on the European market continue to improve in the survey, which points towards very positive second and third quarters of the year.

According to companies surveyed, best prospects are expected to be in the CEE, French, German, Italian and UK markets.

Assessments of the Benelux, Scandinavian and Spanish markets lag behind this, yet are still seen as positive. However, expectations for the markets in Russia and Turkey were less optimistic in the May 2021 survey.

There is no doubt that the sales statistics for the Q2 2021 will show impressive growth rates, which will be across all European market regions and product sub-segments.

Economic consequences of lockdown

The fact that the industry will be comparing sales levels with Q2 2020, when the sector was heavily affected by lockdowns across Europe, suggests that year-on-year comparisons will show double-digit growth levels.

It is expected that growth will reduce gradually in the second half of the year, due to a combination of the supply side constraints mentioned and the fact that comparisons will be made with much stronger sales in the second half of 2020.

The world market for construction equipment saw an exceptional Q1 2021 with sales growing by almost a third. This was driven by the phenomenal development of the Chinese market, which raises initial concerns about the risk of the industry overheating again.

Globally all market regions recorded sales growth in Q1 2021, which confirms the extent of the current pick-up in the market.

In May’s Barometer survey, CECE members were most confident about the North American market. This is probably attributable to positive news about the fight against the Covid-19 pandemic in the US, and the expectations of the benefits of the Infrastructure Bill.

China, India, Latin America and the Middle East were viewed less positively, but optimism outweighed scepticism in the survey.

CECE’s Business Climate Index, measured in the monthly Business Barometer survey, has rebounded strongly since its low of May 2020

CECE’s Business Climate Index, measured in the monthly Business Barometer survey, has rebounded strongly since its low of May 2020

CECE represents the interests of national construction equipment manufacturer associations in 13 European countries. The sector counts around 1,200 companies who employ about 300,000 people directly and indirectly.

Click here to visit the CECE website | Click here to view CECE video on sustainable construction

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM