South America set for strong construction equipment sales…but only if political stability holds

18 October 2023

Construction work in Ipanema, Rio de Janeiro, Brazil (Image: marchello74 via AdobeStock - stock.adobe.com)

Construction work in Ipanema, Rio de Janeiro, Brazil (Image: marchello74 via AdobeStock - stock.adobe.com)

South America can look forward to several years of solid construction equipment sales between 2023 and 2027, after several years of turbulence.

That’s according to a new forecast from specialist market research company Off-Highway Research, which has launched a new service focused on the continent.

Off-Highway Research’s managing director Chris Sleight told International Construction that a resurgent Brazil meant that the South American construction equipment market could look forward to sales in excess of 50,000 units a year for the five-year period between 2023 and 2027.

That would mark a welcome change to several years of volatility where political scandals across the continent affected the health of the market, resulting in a series of peaks and troughs in sales.

“Historically, South America has been a very up-and-down market,” Sleight said.

“That is really more for political reasons than anything else. The last big drop in sales in the 2010s could be linked to the Petrobras scandal in Brazil. That really paralysed the industry because we saw senior executives at some major contractors going to prison.”

The scandal took several years to resolve itself but more recently, economic stimulus across South America has helped to push sales towards a new peak.

“Lift-off came in 2021, as it did for most of the markets around the world, as stimulus measures triggered enormous demand for construction machines. In South America’s case the market doubled in a year,” Sleight explained.

In 2022, sales across the five biggest markets of Argentina, Brazil, Chile, Colombia and Peru totalled more than 65,000 machines, with a value of more than US$8.5 billion.

If the market were to follow the pattern of the last two decades, then it would be tempting to forecast another dip after such highs.

But this time could be different, according to Off-Highway Research.

It has forecast a fall to more sustainable levels of sales in 2023, at around 54,000 units and then several more years of sales in the range of 57,500 to 58,500, up until 2028. The driving force behind those numbers is a growing population and an increasing need for infrastructure.

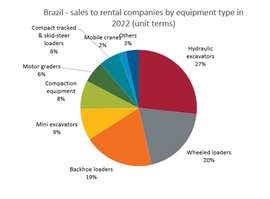

The South American market is also benefiting from greater maturity, with a bigger rental industry that has emerged from the hard times of the 2010s and now accounts for more than 25% of sales.

Sleight added, “Equipment choices also show some of the hallmarks of a maturing industry, with growth in compact excavators, small wheeled loaders and telehandlers – machines which typically replace manual labour or less sophisticated solutions.”

Brazil’s outsized influence

The caveat to that forecast is political stability, particularly in the case of Brazil, which accounts for 70% of construction equipment sales in the region.

A comprehensive, newly published report by Off-Highway Research into the Brazilian construction equipment industry shows how the country has seen steady and strong growth between 2018 and 2022.

Over that time, sales have increased from 12,825 units in 2018 to 45,375 units in 2022, representing a compound annual growth rate (CAGR) of 37.1% over the period.

Sleight said he expects the market in Brazil, to remain strong.

First of all – and this applies to South America as a whole – high commodity prices have fuelled demand for equipment in extraction and agriculture. Even as a spike in inflation falls, Sleight expects demand for commodities to remain strong enough to keep driving capital investment in equipment.

As far as Brazil itself is concerned, Sleight sees encouraging signs when it comes to the country’s current political direction.

“The second positive we see in Brazil is a renewed focus on infrastructure investment through PAC (Growth Acceleration Program), a key policy initiative by President Lula da Silva in his first term of office from 2003-2010 and one he was swift to resurrect on taking office at the start of this year,” he added.

A renewed focus on infrastructure investment should help to drive investment in equipment. Reduced sales in the late 2010s means that such investment is sorely needed.

The country’s fleet of equipment is old and needs to be replaced, and Sleight said that the current period of prosperity should give buyers the confidence to renew worn-out machines such as excavators, crawler dozers and mobile cranes.

Brazil faces a presidential election in 2026 and Off-Highway Research’s report indicated that there could be a small decline that year for some product lines due to uncertainty.

Nonetheless, government infrastructure programmes, housing programmes aimed at supporting low-income families to purchase a home, and expanding agricultural demand should all help to spur growth.

Talking about the South American market as a whole, Sleight concluded, “We feel that as long as there is political stability, the economic conditions in South America are ripe for a good medium-term market.”

To read the market report on Brazil in full, click here to access Off-Highway Research’s website for more details.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM