Electrifying change

Partner Content produced by KHL Content Studio

02 December 2025

In a recent report on the electrification of construction equipment, industry consultancy Off-Highway Research (OHR) said global market penetration of electric machines was just 0.8%.

Combinations of hardware and software platforms are now accelerating the adoption of all-electric, zero-emission construction equipment. Image: Adobe Stock

Combinations of hardware and software platforms are now accelerating the adoption of all-electric, zero-emission construction equipment. Image: Adobe Stock

OHR did, however, forecast this figure growing to more than 3% by 2028, in areas where electric machines are available.

Some less conservative industry bodies have suggested the figure could be as high as 10% by 2030.

This would represent nothing less than a seismic shift in the attitude of owners and operators, and unquestionably the momentum with original equipment manufacturers (OEMs) is toward bringing more battery-electric-powered machines to the market.

The pragmatic view on electrification

Nate Keller is business development manager with the technology company Moog Construction. He believes that, rather than going all in for a full battery-electric solution, a more sensible path is to combine hybrid architectures, diesel-electric combinations and modular systems that balance integration with a more flexible approach.

The introduction of electronic controls can potentially enhance the efficiency of machine hydraulics

The introduction of electronic controls can potentially enhance the efficiency of machine hydraulics

“Firstly,” he says, “electrification does not have to mean only zero emissions. With that in mind, there are a number of ways to get the benefits of electrification without adding significant machine cost.

“For example, a machine doesn’t have to use batteries as its primary source of power; diesel generators with or without battery storage can be used to greatly increase the performance and efficiencies of the propulsion and working functions of off-highway mobile equipment, without major impact on the overall cost.”

Keller says another misconception is that electrification means removing hydraulics.

“Hydraulics have the significant advantage of high-power density, and this will keep them relevant in this industry, especially in medium to large machines.

“Hydraulic systems can be more efficiently designed when the pumps are controlled by electric motors, which increases the flexibility and control and helps reduce operating costs and increase performance for operators.”

Market drivers and operator demands

In his role with Moog, Keller receives plenty of feedback from industry professionals, many of whom are considering a first move into electric power.

He says the shift to electric power is primarily being brought about by “end users demanding machines with better performance, with lower operating costs and, ultimately, a lower total cost of ownership [TCO] than the previous generation of machines.”

He also notes that performance means different things on different machines. “On a compact track loader or skid steer loader that could be versatility, whereas on a 20-ton excavator, it could be productivity or the rate of material movement.

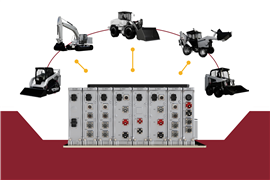

Moog’s Adaptive Electrification Management System provides scalable electrification across all sizes of off-highway machinery

Moog’s Adaptive Electrification Management System provides scalable electrification across all sizes of off-highway machinery

“This demand for higher performance and lower operating costs pairs well with electric motion control. The efficiency and performance benefits of electrification are causing OEMs to evaluate the system architectures of their equipment and provide the market with machines that offer higher performance and lower operating costs, while minimizing the impact on initial cost.”

Keller believes there are a number of misconceptions, even among OEMs, when it comes to the challenge of electrifying construction equipment.

“There’s a notion that electrification is significantly more costly than traditional diesel hydraulic machines,” he says, “and that the next generation of machines must be powered solely by electric batteries.

“In fact, the system architecture for each machine type, size and application needs to be evaluated to determine the configuration that optimizes cost, efficiency and performance.”

Modular systems offer flexibility

While Keller acknowledges that batteries currently add cost to the machine and there are still challenges regarding range, charge time, charging infrastructure and lifespan, he counters that OEMs have been pleasantly surprised at the advanced controllability, increased performance and reduced operating costs that electric control provides.

“There are ways to get the benefits of electrification without adding significant machine cost,” he says.

One of these ways is the adoption of a modular system, potentially retrofitted on a diesel machine – a relatively simple switch from diesel to electric control.

Keller says, “OEMs need to strike a balance between modularity and fully integrated solutions, depending on machine type and application.

The latest modular control systems can be integrated into a wide range of electric and electrohydraulic vechicles. Image: Adobe Stock

The latest modular control systems can be integrated into a wide range of electric and electrohydraulic vechicles. Image: Adobe Stock

“Modularity allows for commonized primary components, such as inverters, onboard chargers and high-voltage distribution modules, that can be used across multiple machine platforms.

“It also helps OEMs in their product development process because, with commonized components, engineering teams always have what they need and understand how those components work. For example, an inverter that is used on a 13-ton excavator can be used on a 20-ton wheel loader.”

Managing complexity

Keller warns, however, that a modular approach can lead to more components, connectors and cables than would be the case with a fully-integrated battery-electric machine.

Keeping this complexity to a minimum is key to the success of the modular approach.

This solution can also allay some of the runtime and charging concerns associated with fully electric machines, where it incorporates a downsized diesel generator with a smaller battery package.

According to Keller, “The downsized diesel engine can run continuously at its optimum efficiency point to charge the battery, while the battery provides the direct power to the functions of the machine.

“While this solution does not provide a zero emissions [ZE] solution, it does significantly reduce fuel consumption, eliminate battery run-time and charging concerns, and provides a limited ZE mode where the machine can run only on the battery for a limited time before the diesel generator would be required to charge the battery.”

Power on demand

New electronic platforms present opportunities for owners to integrate both electric power and automation into their diesel fleets

New electronic platforms present opportunities for owners to integrate both electric power and automation into their diesel fleets

This hybrid option also comes with the benefit of giving the machine that instantaneous high power that has supercharged the growth in sales of electric cars.

As Keller explains, “A machine with a 74HP diesel engine could never output more than 74HP without a significant source of energy storage, such as a battery or hydraulic accumulator.

“A battery-electric machine is easily capable of outputting power well above 74HP because of the stored energy within the battery. In applications where short duration and high-power instances can occur, such as driving into a compacted pile with a wheel loader, the energy storage can provide the extra power only when needed.

“This could result in an owner not needing to purchase the higher power engine and still give the operator the necessary power to efficiently complete the job.”

Another tick for battery-electric machines is in uptime, with fewer parts leading to increased service intervals and reduced time when servicing is required.

And, as we look to a future in which more automation is likely, the ability to draw and analyze valuable data from electrified machines is significantly greater than from their diesel counterparts.

The data and automation edge

“With all the data and the known instantaneous status of the machine available,” says Keller, “it opens the door for automated control and even full autonomous operation. Control software can augment what operators are doing to increase productivity and/or increase machine efficiency.”

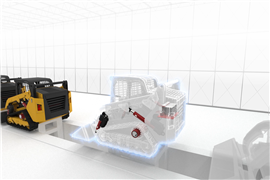

On the practicalities of bringing together the electrical and mechanical in this way, Keller offers Moog’s TerraTech electrification solution, a collaborative system for OEMs that simplifies the integration of electric systems within conventional machines.

Moog Construction’s integrated machine control architecture results in a reduction in cabling of up to 70%

Moog Construction’s integrated machine control architecture results in a reduction in cabling of up to 70%

In basic terms, TerraTech’s adaptive integrated electronics management system (AEMS) allows for a reduction in wiring complexity and makes communication across components much more straightforward.

Keller says the system can “minimize parts and supplier dependencies and means engineers can focus on things like maximizing performance, rather than having to worry about operational hurdles.”

The technology also promises to shorten production cycles and enhance cost efficiency, as well as being adaptable to market changes, due to its common software platform.

An electric future

As things stand, it seems likely that electric motion control will form a significant part of the future machine mix – probably with a continuing requirement for hydraulics.

The main power source, however, is less certain and will likely be a combination of diesel, hydrogen, biofuel and batteries.

As OEMs refine their system architectures to balance modularity with integration, many are recognizing that electrification is unlikely to be a wholesale replacement for diesel; rather it will form a significant part of smarter and more adaptable machines.

The next decade will likely be defined by how effectively the industry blends these power sources to deliver greater productivity with lower environmental impact.

--------

This article was produced by KHL Content Studio, in collaboration with experts from Moog Construction

--------

All uncredited images courtesy of Moog Construction

--------

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM